By Iron Tiger

If you watch the Legacy News Media, you would think the inflation problem is solved, that everything has gone back to normal, and that everything is fine. But when you go to the grocery store or go to put gas in your car, you might find the reality doesn’t quite match what you are being told. You see we’re celebrating that the month-over-month rate of inflation fell to 4%, only 2% higher than the federal reserve’s goal of 2%. But this celebration belies the reality, things are still quite a lot more expensive than they were just a few years ago. Prices have not begun to fall, and in fact, continue to rise.

Gas is right around $4.00 a gallon again. The cost of milk and eggs continues to be at historic highs. The government is still excluding the cost of food and energy in its inflation reports. Wages remain stagnant, and the state of the economy remains weak. The problem is not solved, and the things that would fix it are policies our current government refuses to entertain, let alone embrace.

The government must cut spending, otherwise, this problem will never go away. The increase in interest rates has helped, and in fact, the Fed decided not to increase it again at their latest meeting, rightly fearing that if they raise it any further, it will apply further pressure against economic growth. But this is where the spending cuts would come in. With a cut to spending, it would reduce demand for additional dollars added to the market to cover the cost of that spending, reducing the value of those dollars. The only way to increase the value of those dollars is for the Fed to pull them back in. But even that won’t be enough with as out-of-control inflation has gotten.

You see the real problem is that this month’s four percent increase is still in addition to the eight percent increase we experienced this time last year. In other words, the problem is not fixed until we have negative inflation or deflation.

For some reason, whenever I talk about this, people around me react in horror. And yet the truth of the matter is that the American Dream continues to get further and further from reach for the average person because things continue to get more and more expensive. So, we have two choices, tie wages to the rate of inflation, which is itself inflationary, and will only cause the problem to get worse, or allow for market corrections to occur. If we chose the latter route, all we need to do is pay off the debt and continue to have a moderate interest rate. Over time, excess dollars will be pulled in, increasing the value of the dollars that remain in the market, bringing prices down, and increasing the buying power of the poor and downtrodden. If we were to do this, it’s even possible we might see that wealth gap start to close, since prices will fall, allowing poorer people to do more with less, sending fewer dollars up the chain to be hoarded by billionaire activists like Alex Soros, and then used to buy themselves more power.

So, it seems that allowing for a market correction to occur can solve a lot of problems, but it also would mean the numbers on Wall Street might drop as well. As an investor, I’m more than aware of that risk. But looking over my stocks right now, most of my holdings are in the red, so it’s not like inflation has proven profitable for investors anyway. Yes, deflation would temporarily devalue the market, but what points remain will have greater value. And since money today moves faster than the speed of thought, I imagine that drop will not be any more serious than what we have experienced lately, and recovery would come quickly, as people would be freer to do more with their more valuable dollars. Those dollars will, of course, work their way back up, healing any temporary damage to the market that going this route might cause.

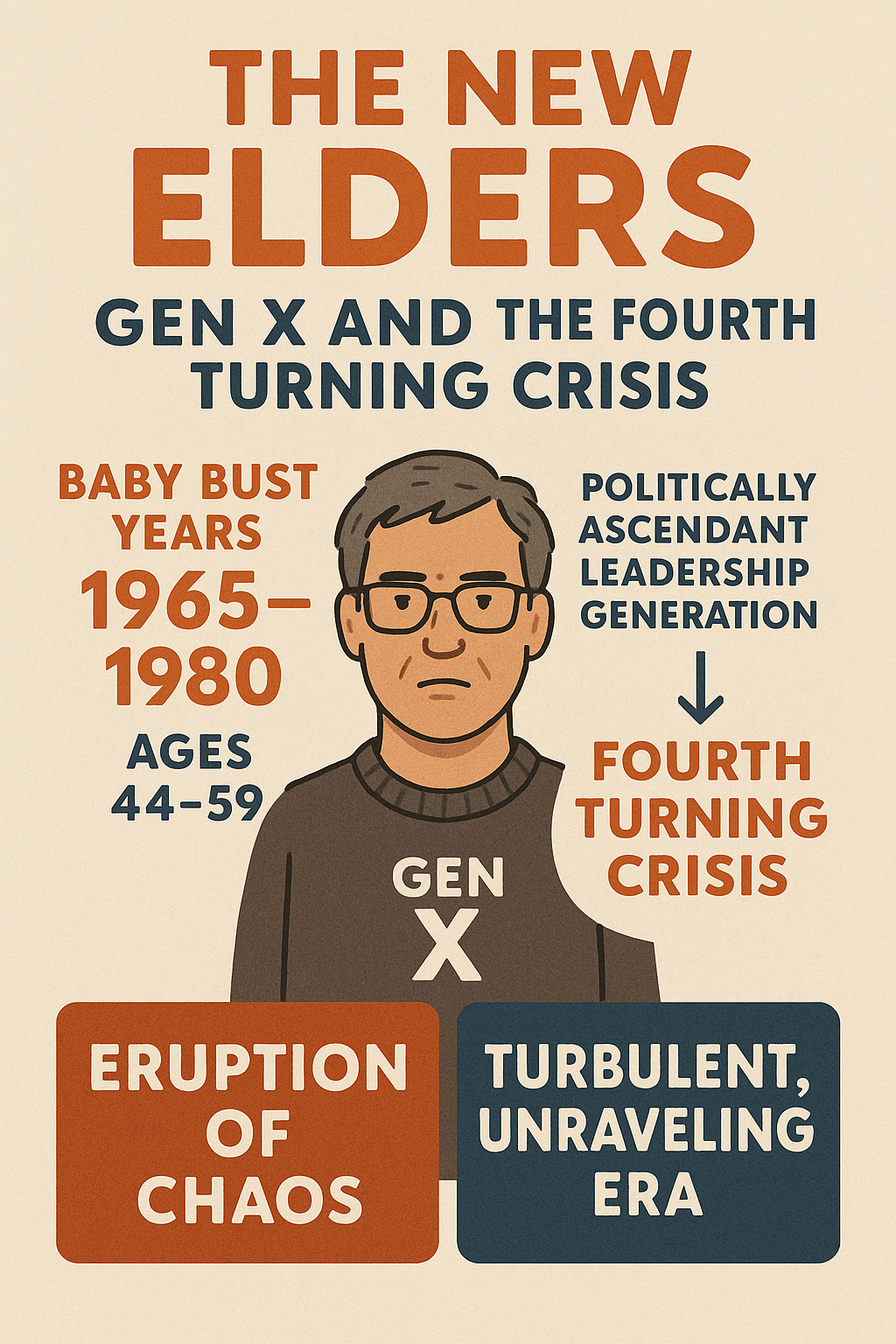

The problem, as I see it, is that we don’t have political leaders willing to give this a chance. Instead, they just want you to pay 2% more every month than you paid the month before. They don’t mind that your costs of living continue to increase. They don’t care that they have made single-income homes all but impossible, or that this has caused a decline in interest in even getting married or having a family. Why bother if you will never be able to spend time with your spouse or children because you keep having to work more and more and more hours to earn dollars that are worth less and less, allowing you to do fewer and fewer things? And until we get leaders who are willing to take a hard look at our economic policies and consider different options, I can’t see any of these problems ever healing.

2 Responses

It’s not that “leaders” are unwilling to allow deflation or that they are ignorant of the problem and how to fix it…it’s that this is going exactly according to their plan. Until people recognize that none of this is an accident and that the people “in charge” *want* The West to descend into a third-world living standards (actually even lower the way I read it) …

Remember, you and I, we are all just “useless eaters” and a temporary complication until their AI is fully capable of replacing us and all of our uppity demands. They write of this fairly openly.

I don’t disagree. As much as I wish it were otherwise. You are absolutely correct.