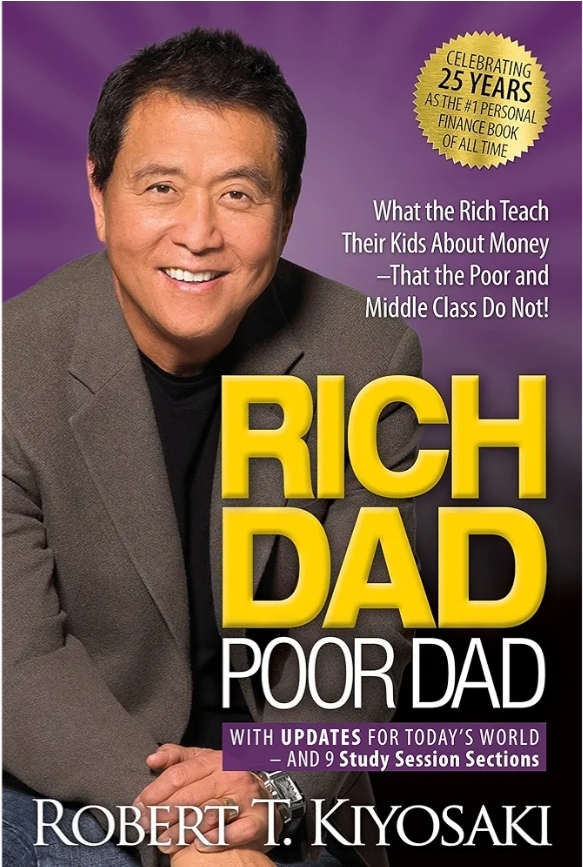

Rich Dad Poor Dad by Robert Kiyosaki – A Detailed Overview

Rich Dad Poor Dad by Robert T. Kiyosaki is one of the most influential personal finance books of all time. Published in 1997, it challenges conventional beliefs about money, financial education, and wealth-building. Kiyosaki uses the contrasting financial philosophies of his “Rich Dad” and “Poor Dad” to illustrate key lessons about money, investing, and financial freedom.

The Core Premise of the Book

The book is centered around Robert Kiyosaki’s experience growing up with two father figures:

- Poor Dad: His biological father, who was well-educated, held a stable government job, but struggled financially. He followed the traditional path of working hard, saving money, and investing in a home.

- Rich Dad: His best friend’s father, who had limited formal education but was a successful entrepreneur and investor. He believed in financial education, making money work for you, and building assets rather than relying on a paycheck.

The contrasting mindsets of these two men shape the foundation of the book’s lessons.

Key Lessons from Rich Dad Poor Dad

Lesson 1: The Rich Don’t Work for Money – They Make Money Work for Them

- Poor Dad’s Mindset: Work hard for a stable paycheck, save money, and avoid risks.

- Rich Dad’s Mindset: Build and acquire assets that generate passive income.

Key Takeaway: Don’t trade time for money indefinitely. Instead, invest in assets that will provide income even when you’re not actively working.

Lesson 2: Financial Literacy Is Essential

- The key difference between the rich and the poor is financial education.

- Assets vs. Liabilities:

- Assets: Put money into your pocket (e.g., rental properties, stocks, businesses).

- Liabilities: Take money out of your pocket (e.g., mortgages, car loans, credit card debt).

Key Takeaway: Focus on building assets and minimizing liabilities.

Lesson 3: Mind Your Own Business

- Even if you have a job, start building your own assets column.

- Examples include stocks, bonds, real estate, royalties, and businesses.

Key Takeaway: Your primary job provides stability, but your assets will build true wealth and financial independence.

Lesson 4: The History of Taxes and the Power of Corporations

- The rich use corporations and tax strategies to minimize their tax burden legally.

- Corporations allow you to:

- Earn money

- Spend money (on expenses related to the business)

- Pay taxes on what’s left

Key Takeaway: Learn how taxes work and how to use legal strategies to your advantage.

Lesson 5: The Rich Invent Money

- The wealthy create opportunities and take calculated risks.

- Many people miss opportunities because of fear of failure or lack of financial knowledge.

Key Takeaway: Develop your financial intelligence and be open to opportunities, even if they involve calculated risks.

Lesson 6: Work to Learn, Not to Earn

- Focus on gaining skills and knowledge that will serve you in the long term.

- Examples include sales skills, marketing, investing, and public speaking.

Key Takeaway: Don’t chase a paycheck—chase skills and experiences that make you more valuable in any field.

The Cashflow Quadrant

Though this concept is expanded in Kiyosaki’s later book The Cashflow Quadrant, it’s briefly touched upon in Rich Dad Poor Dad:

- E – Employee: Works for someone else for a paycheck.

- S – Self-Employed: Works for themselves (doctors, freelancers).

- B – Business Owner: Owns a system or company that makes money without their constant involvement.

- I – Investor: Makes money from money through investments.

Key Takeaway: Strive to move from the left side (E and S) to the right side (B and I) of the quadrant to achieve financial freedom.

The Mindset Shift: Overcoming Fear and Doubt

- Fear: Fear of losing money prevents many from taking opportunities.

- Cynicism: Overthinking and doubting opportunities can paralyze you.

- Laziness: Often masked as “busyness.”

- Bad Habits: Spending before saving rather than saving before spending.

- Arrogance: Thinking you already know everything can prevent learning.

Key Takeaway: Master your emotions and fears related to money.

Practical Steps for Financial Independence

- Start Small: Invest even small amounts in assets.

- Educate Yourself: Read books, attend seminars, and learn about investing.

- Network: Surround yourself with people who understand money and wealth-building.

- Take Action: Knowledge without action is meaningless.

Key Quote: “Financial freedom is not about how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

Criticisms of the Book

While Rich Dad Poor Dad has inspired millions, it has faced criticism:

- Lack of Concrete Steps: Some readers find the advice too theoretical.

- Ambiguity About Rich Dad’s Identity: There is debate about whether Rich Dad was a real person or a composite character.

- Risk Emphasis: Some argue Kiyosaki downplays the risks of investing.

Despite these criticisms, the core principles of financial literacy, asset-building, and mindset shifts remain universally valuable.

Key Takeaways from Rich Dad Poor Dad

- Focus on assets, not liabilities.

- Build passive income streams.

- Financial education is more important than academic education.

- Learn to make money work for you.

- Take calculated risks and be open to opportunities.

Final Thoughts

Rich Dad Poor Dad isn’t just a book about money—it’s about rethinking your relationship with wealth, work, and success. Kiyosaki challenges readers to break free from the traditional mindset of “go to school, get a job, save money, and retire” and instead take control of their financial future through education, strategy, and action.

Would you like to discuss a specific chapter, explore an idea in more detail, or dive into actionable steps for applying these principles in your life?