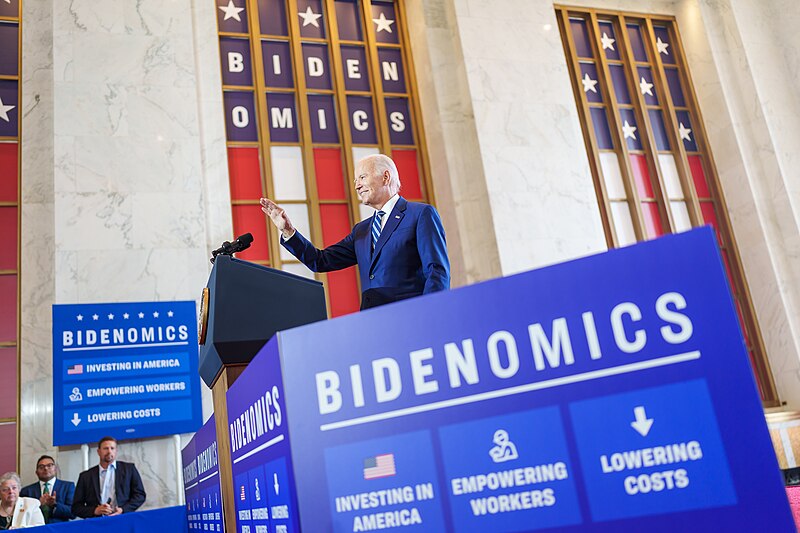

The news media was doing a massive victory lap this week as the GDP report came out, and revealed incredible growth this last quarter, at a time when a recession has been looming over the horizon. The GDP somehow grew from 2.1% to a seasonally adjusted 4.9%. On the surface, this is huge news. After all, the Biden Economy has been slow and stagnant for quite some time. Yet growth like this would normally be an indicator that the economy is finally making a turn for the better . . . keyword is normally. Obviously, the media wants you to believe that Bidenomics is working, but I don’t know about you, but I’m certainly not feeling that great economic growth.

While rich people on TV try to convince us that all is well, I look at the gas prices, still double what they were under the Trump administration. I look at grocery prices, and I still see prices significantly higher than they were under the previous administration. Prices are not coming down. Wages are not going up. The economic conditions for the poor and middle class continue to circle the drain, while the government is sitting pretty, spending trillions on their own special projects, never mind the impact of that spending on inflation, and the increases in interest rates that spending has necessitated in order to combat inflation.

But see the biggest contribution to the growth of the GDP, ironically, is government spending, which went up about 4.6% . . . It’s not much different than if you were to say your own economic standing was improving because you got a brand-new credit card, and immediately ran it up. It may make you look more prosperous when you buy a brand-new boat to show off to your neighbors, but the piper will come to collect one day. The bill for all that spending will still come due.

Next, we see businesses increasing inventories. But there are two reasons for this. Inflation is still a problem, so naturally, businesses are trying to build their inventories now, so they don’t have to pay more for it down the line. You can expect your prices to go up, however, as businesses try to get ahead of our continued inflation problems. The second reason is to prepare for Black Friday, Cyber Monday, and the forthcoming holidays. Better to ready for that now, than next month when prices will be up, yet again.

Consumer spending, meanwhile, made up 2.7% of the increase in GDP, but this is partly because the average person is also trying to build a backlog for food and other necessities before prices go up, particularly to get ready for the upcoming holidays, and mostly because people are paying higher prices for just about everything.

While the spending on food, energy and other necessities has climbed, real disposable income, meanwhile, has fallen by 1.0%. Meaning extras, entertainment, etc, declined. Not to mention the state of the housing market. With inflation rates where they are, people who would move are stuck in their homes purchased when the inflation rate was lower. Those seeking to move out of their parent’s home are unable to afford houses at their elevated prices, and the elevated inflation rate. We have a high demand for more homes, but no ability to build new homes, and no ability to move what homes they have because it’s just too expensive. This is a problem that has gotten very little attention, but the economy will never recover while this issue remains unaddressed. The automobile market is experiencing similar issues with strained inventories of used cars, and the cost of new cars exploding, and the interest rates for vehicles as well.

If circumstances were different, a GDP growth like this would be worth celebrating. But as an investor, still looking at my investments being perpetually in the red, with no sign of growth, the total opposite of where they were nearly four years ago, combined with the poor fundamentals on the ground, I think Biden and his friends in the press are declaring victory far too soon.

The solution hasn’t changed. Government spending must be reined in, the debt must be paid down, and the market must be allowed to have a corrective period, where prices cool, and come back down to earth. If we don’t do these things, the economy will remain poor, regardless of GDP.

One Response

Great insight, and I do believe you nailed

Thank you