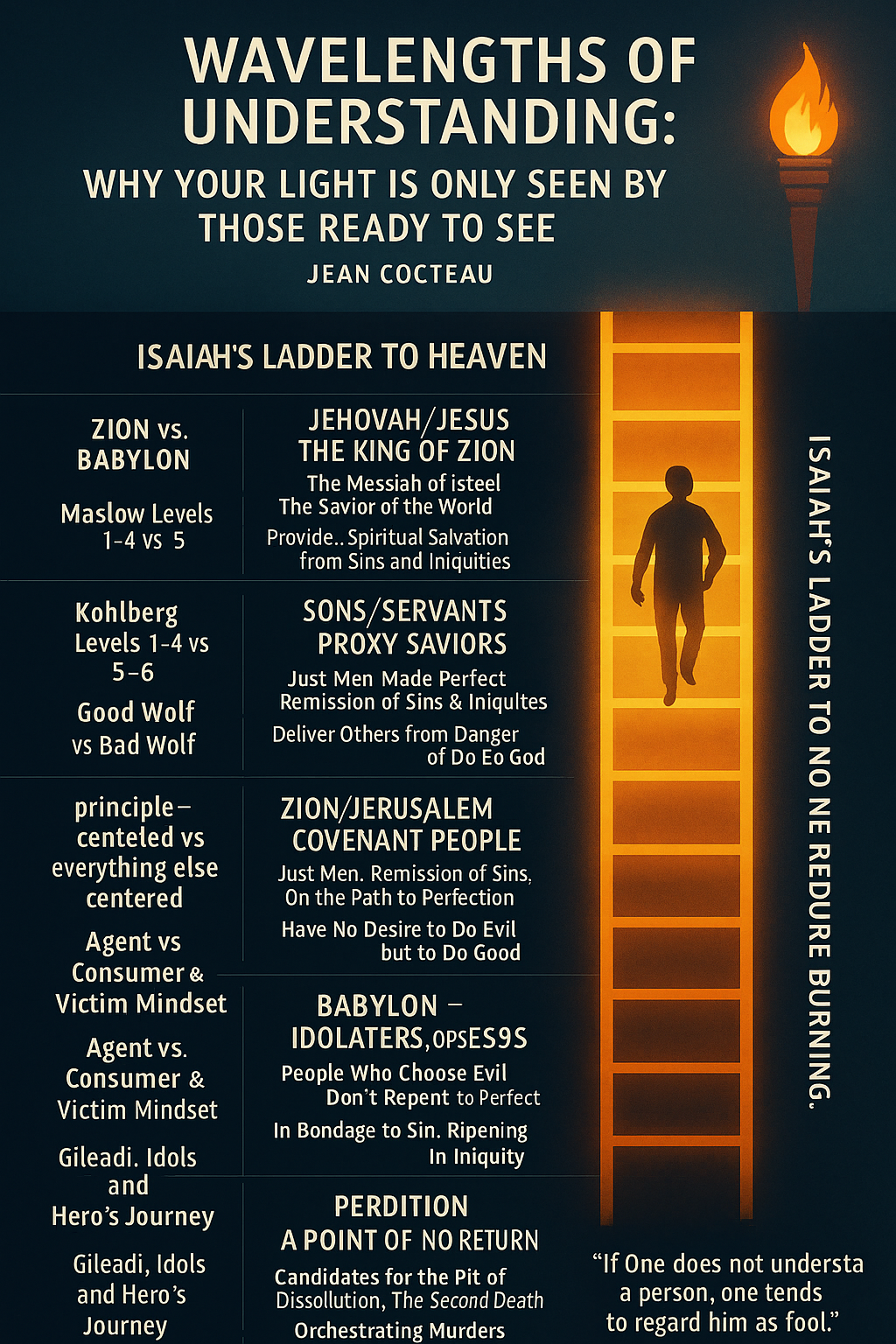

The spiritual and intellectual roots of the Coinage and “Weights and Measures” clauses of the Constitution lies directly in the Old Testament. Consider, for example, the following Old Testament references:

Thou shalt not have in thy bag divers weights, a great and a small. Thou shalt not have in thine house divers measures, a great and a small. But thou shalt have a perfect and just weight, a perfect and just measure shalt thou have: that thy days may be lengthened in the land which the LORD thy God giveth thee. For all that do such things, and all that do unrighteously, are an abomination unto the LORD thy God.

Deuteronomy 25:13–16

Just balances, just weights, a just ephah, and a just hin, shall ye have: I am the LORD your God, which brought you out of the land of Egypt.

Leviticus 19:36

Ye shall have just balances, and a just ephah, and a just bath.

Ezekiel 45:10

Saying, When will the new moon be gone, that we may sell corn? and the sabbath, that we may set forth wheat, making the ephah small, and the shekel great, and falsifying the balances by deceit?

Amos 8:5

Divers weights, and divers measures, both of them are alike abomination to the LORD.

Proverbs 20:10

Are there yet the treasures of wickedness in the house of the wicked, and the scant measure that is abominable?

Micah 6:10

In order for both buyers and sellers to deal equitably and justly with one another, there has to be standardized weights and measures. Further, those weights and measures have to be fixed and certain. There can’t be fluctuating inches or yards; and fluctuating ounces or pounds. The standard has to be fixed and certain, otherwise uncertainty, inequity and injustice prevail. The same thing applies to money, it can’t be fluctuating in its value if both buyer and seller are to be justly treated.

Yet, today, we have a “fluctuating” and “managed” currency under the Federal Reserve System. Further, it is a debt money system. Every “dollar” that is in circulation exists because it was borrowed, from someone, at some time, at some place, into circulation. Because it was borrowed into circulation then it represents debt and needs to be repaid, with interest. Look at your paper money. At the top, it states: Federal Reserve Note. It is just that, a note, and represents debt.

When that particular debt is repaid it extinguishes those particular notes, and they no longer exist. When debt repayment is large and widespread the money supply shrinks overall, and deflation occurs. Provide easy and unrestricted credit then artificial booms become the norm. Inflation of the money supply (as well as the price of everything else) results. Either way, it is a managed currency and can be manipulated in certain ways, and it is a fluctuating medium of exchange.

Former Congressman Charles A. Lindbergh Sr. figured it out. He figured out that, “From now on, depressions will be scientifically created.” The depression of the 30′s was caused by the credit expansion of the 20′s and then a contraction, all of it engineered by the Federal Reserve. Since then, all of the recessions and periods of inflation have been caused by the credit expansions or contractions of the Federal Reserve. Every recession and period of inflation is caused by the Fed. They either expand or contract credit.

Contrast this Federal Reserve debt system with a credit money system. Under the original Constitution, and due to the 1st Coinage Act of 1792, anybody could take their gold and silver bullion to the mint, have it coined, and then returned back to them as coins. It was a system where the people (along with the cooperation of the mint) created the coins, so they were in control, not the government. It was a positive, wealth building, credit money system rather than its opposite a negative wealth destroying (through inflation) debt-based money system.

A friend once asked me, “how [then does] a finite quantity of gold handle an expanding economy, [which] expand[s] at an increasing rate, up to [an ever expanding] point?” To which I answered, “supply and demand.” The supply of gold and silver doesn’t fluctuate, except at the rate at which new gold or silver is mined, which when compared to the total supply of gold or silver in the world is relatively negligible. Except for very rare occasions such as the Spanish conquest, the California and Alaskan gold rush’s, or the Nevada silver mine era.

Since the supply of gold and silver is relatively stable it’s “value” can fluctuate only according to the demand of it. In an ideal world where only gold and silver coins were money, and there was no such thing as paper money, an “expanding economy” would place more demand for gold and/or silver coins. Because in an “expanding economy” there are more things to buy each coin could buy more things than they did last year or ten years ago.

There is no need for paper money to meet the demands of an expanding economy. And it is one of the biggest lies and myths there is that somehow there is not enough gold and silver in the world to be money. If there is more demand for money (gold and silver coins) then the value of money (gold and silver coins) goes up to meet the demands of the economy. If there is less demand for money (gold and silver coins) due to whatever reason, then each coin buys less. It’s actually pretty simple, but economists have pretended to make it more complicated than it actually is. The reason gold and silver (and everything else) go up in today’s economy is that there is more and more paper money being made.

Paper money needs to be demolished and done away with. There is no need for paper money. If a private citizen or group of citizens want to use checks drawn upon a local bank (remember only gold and silver coins are money) that is perfectly permissible. If a private citizen or group of citizens want to use credit or debit cards issued by a local bank (remember only gold and silver coins are money) that is perfectly permissible. There is really no need to carry a big bag of gold coins to the car dealer to buy a car since a check, credit or debit card, or perhaps some other kind of financial instrument will suffice. Besides, in reality, because of the great demand for gold and silver coins in an expanding economy, you’d probably only need a few gold coins to buy that fancy new car, and not a big heavy bag.

Many have also asked me questions like, “why can’t we use paper money backed by gold and silver coin?” Here why. Under the original Constitution, the power to issue “Bills of Credit” or otherwise “redeemable notes” was a power denied to the Federal Government on August 16th, 1787 (scroll down to immediately after FN19 in the link where it begins, “Mr. Gov’r Morris.”) Money was simply gold and silver coin. Period. No paper notes. Nada. Zilch. There was no crack left open by our founders for government thieves to sneak in. In fact, Mr. Elseworth in the debates of the Constitutional Convention thought that by denying the Federal Government the power to issue “bills of credit” or paper money that it was a “favorable moment to shut and bar the door against paper money.”

The Constitution gave Congress the power to fix a standard of weights and measures. Interestingly enough this power was granted right after the power to Coin Money, etc. Under the 1st coinage act of 1792, it was a silver standard. The Dollar was defined as 371.25 grains of silver. And the official unit of account of the United States was the Dollar. Further, the standard, just like the standard for the mile, inch, yard, pound, gallon, or ounce, etc., was to be “fixed and certain.” I’m not saying that Congress could never change it, but it probably should not be changed for light and intransitive causes. Otherwise why even have a standard at all?

Not by accident but by design, the Constitution gave Congress the power to also “regulate the value” of not only our domestic gold and silver coin but also foreign coins. This meant that all other coins besides the “Dollar” were to be regulated against that standard. So if you had a silver coin that had 3712.5 grains of silver in it it would be of the value of Ten Dollars. Congress was also to determine the free market ratio between Gold and Silver. In 1792 the ratio was 16:1. So if a gold coin contained 1/16 of 371.25 grains of gold (a little over 23.2 grains of gold) it would be of the value of one Dollar. It didn’t matter if the gold or silver coins were domestic coins or foreign, all were regulated according to the standard.

Very simple really. Too bad so many think the founding fathers, who set up such a great system, were economically and politically backward.