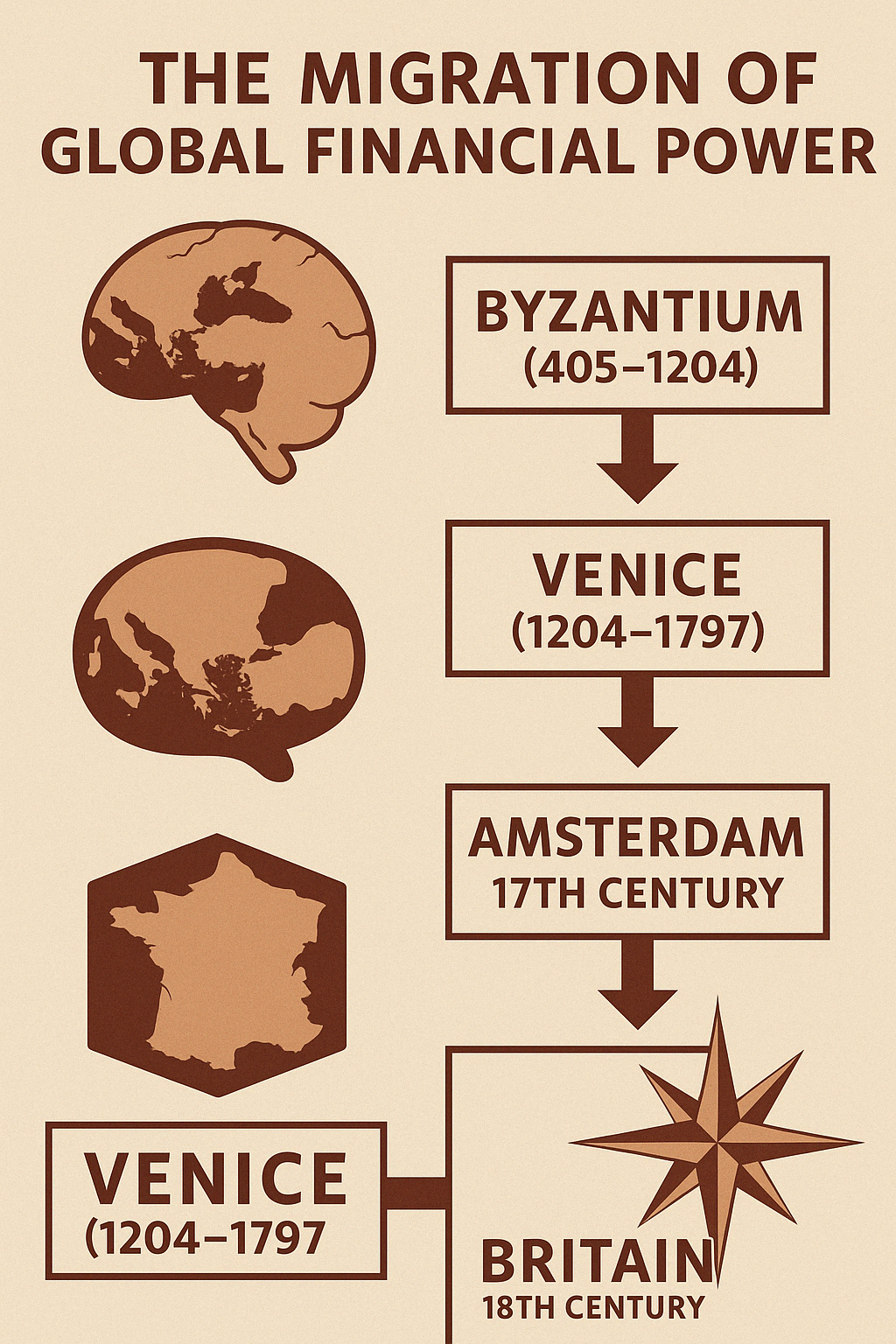

The Fall of Byzantium (1453):

- Byzantium (the Eastern Roman Empire) fell to the Ottoman Turks in 1453.

- For centuries before its fall, Byzantium had been a crucial hub of global trade between Europe and Asia (the “Silk Road” flowed through its territories).

- Byzantium was also a major center of banking, finance, and commercial law — it inherited much of the Roman legal tradition, particularly in commerce and contracts.

When Byzantium fell, powerful merchant families, banking elites, scholars, and remnants of the financial class scattered, especially toward two key destinations:

- Northern Italy (particularly Venice, Genoa, Florence)

- Western Europe, including parts of Spain and the Low Countries (modern Belgium/Netherlands).

Venice and Genoa: The Next Commercial Empires

- Venetian and Genoese bankers and merchant families absorbed a large part of the knowledge and capital networks from the fallen Byzantine order.

- Venice especially became a dominant maritime trading empire in the late 1400s.

- Venice perfected the first modern banking systems, commercial shipping fleets, and diplomatic espionage.

However, Venice was relatively small, and by the 1500s, the expansion of Atlantic trade routes (bypassing the Mediterranean) started to diminish its dominance.

The Rise of Spain and Portugal (15th–16th Century):

- After Venice, Spain and Portugal emerged as the next centers of global commerce.

- Backed heavily by merchant banking families, Spain financed:

- Christopher Columbus’s voyages.

- Global colonization of the Americas.

- The Spanish Empire was a fusion of royal power + merchant/oligarchic banking interests.

- The Catholic Church (Vatican) was a major banking power during this time too (financing voyages and colonization projects through “Christianizing missions”).

BUT: the Spanish and Portuguese empires were very imperial (dependent on royal dynasties), and the merchant elites wanted more flexible, freer economies that didn’t rely so much on kings or papal decrees.

The Shift to the Low Countries (Netherlands, Amsterdam, 1600s):

- By the late 1500s and early 1600s, Amsterdam became the next great hub of world finance.

- The Dutch East India Company (VOC) was the world’s first multinational corporation.

- The Amsterdam stock exchange (founded 1602) became the first real securities market — corporations could raise money from many investors without needing royal charters.

- Merchant elites preferred this system: less dependent on kings, more self-controlled.

However, Amsterdam was vulnerable to larger military powers.

Britain: The “Perfect Host” for the Oligarchy

Yes, Britain was the next and most successful host for global oligarchic and merchant powers after Byzantium. Here’s why:

- After the Glorious Revolution of 1688, the Bank of England was founded (1694).

- Britain created a “mixed” system:

- A constitutional monarchy (king and Parliament had to share power).

- A private banking system tied to the government (merging public power and private banking — a new model).

- London became the center of global insurance (Lloyd’s), banking (Bank of England), and shipping (British Navy).

- Merchant and banking elites could now:

- Fund wars (profiting from both sides).

- Expand colonies.

- Control global resources without necessarily being kings themselves.

- The City of London (the financial district) became a “sovereign entity” within Britain, operating almost like the Vatican — outside the full control of the national government.

Thus, the oligarchic merchant powers, stretching back from Byzantium, Venice, Spain, Amsterdam, finally found their “permanent empire” through the British system.

In Summary: The Migration Path of Global Commerce Oligarchs

| Timeframe | Main Power Center | Notes |

|---|---|---|

| 330–1453 AD | Byzantine Empire | Inherited Roman legal and financial systems. |

| 1100s–1500s | Venice, Genoa | Maritime republics, banking innovation. |

| 1500s–1600s | Spain, Portugal | Global empires fueled by colonial plunder. |

| 1600s | Netherlands (Amsterdam) | Stock markets, multinational corporations. |

| Late 1600s onward | Britain (London) | Private banking powers merged with empire building. |

Deep Reflection:

- Commerce and banking power never truly “died” — it simply shifted hosts.

- Britain’s empire (and later America’s) operated on behalf of global finance, not just national interest.

- Today, the successors to this system (the “global elite”) are still operating under the same structure: finance, commerce, and governance merged together.

The Migration of Global Commerce Powers: From Byzantium to Britain (and Beyond)

Historical Timeline Summary

Byzantine Empire (330–1453 AD)

- Role: Preserved and expanded Roman commerce, banking, and legal structures.

- Center: Constantinople — vital link between East and West trade (Silk Road, spice trade).

- Fall: Conquered by the Ottoman Empire in 1453.

- Aftermath: Merchant and banking elites dispersed into Italy and Europe, carrying banking, finance, and legal expertise.

Italian Maritime Republics (1100s–1500s)

- Key Players: Venice, Genoa, Florence.

- Contributions:

- Innovations in maritime law, public finance, and credit instruments.

- Establishment of early joint-stock companies and government bonds.

- Decline: Discovery of Atlantic routes shifted trade focus from the Mediterranean to the Atlantic world.

Spanish and Portuguese Empires (1500s–1600s)

- Expansion: Colonized the Americas, Africa, and parts of Asia.

- Strengths: Wealth influx from silver and gold mines.

- Limitations: Extractive economic model led to inflation and decline in productive capacity.

Dutch Republic (Netherlands, 1600s)

- Golden Age:

- Amsterdam became the new financial center.

- Dutch East India Company (VOC) pioneered corporate finance and global trade monopolies.

- Challenges: Small population and territorial vulnerability against larger powers.

Britain (London, late 1600s onward)

- Transformation:

- Post-Glorious Revolution: Parliament gained supremacy.

- 1694: Bank of England founded, embedding finance within governance.

- Global Ascendancy:

- London established itself as the global banking and insurance hub.

- British Empire’s naval supremacy ensured dominance of global trade routes.

New Host: United States (Wall Street, 20th Century)

- Rise:

- After World Wars, financial leadership shifted from London to New York.

- Bretton Woods institutions (IMF, World Bank) established the global dollar system.

Key Insights and Legacy

Why Britain (and Later the U.S.) Became New Hosts

- Political Reforms: Predictable governance attractive to merchants.

- Strong Legal Foundations: Contract law, property rights.

- Maritime and Military Superiority: Protection and enforcement of trade.

- Financial Engineering: Expansion of sophisticated instruments (central banking, insurance, corporate finance).

Core Strategy of Global Commerce Elites

- Migration to Rising Powers: Always aligned with political-economic stability (Venice → Amsterdam → London → New York).

- Government-Private Sector Symbiosis: Influence without overt control.

- Control of Trade & Financial Infrastructure: Key to enduring dominance.

- Innovation of Financial Tools: Bonds, derivatives, insurance, and eventually digital finance.

Legacy into the Modern Era

- Financial Globalization: IMF, World Bank, BIS continue patterns of financial elite coordination.

- Deep State Influence: Financial institutions often shape domestic and foreign policy.

- Current Shift: Emerging centers (Singapore, Dubai, Shanghai) show that commerce migration continues.

- Cyclical Pattern: Financial elites use “host nations” until instability or diminishing returns push migration again.

Reflection: “Commerce migrates; sovereignty follows. Financial power sets the stage for political dominance.”

Key Families & Bloodlines Timeline

Medieval to Renaissance Banking Dynasties

- Medici Family (Italy):

- Founded first modern banking system.

- Major political influence across Europe.

- Fugger Family (Germany):

- Financed Habsburgs and major European monarchies.

Early Modern Era

- Rothschild Family (Europe):

- 5 brothers across European capitals created first international banking network.

- Financed wars, railways, and governments.

Later Financial Dynasties

- Rockefeller Family (U.S.):

- Dominated oil industry, expanded into banking and global philanthropy.

- Morgan Family (U.S.):

- JP Morgan crucial in stabilizing U.S. financial system (e.g., Panic of 1907).

Modern Extensions

- Global Investment Firms (e.g., BlackRock, Vanguard):

- Hold trillions in assets, influencing global corporate governance.

- New Dynasties: Tech oligarchs emerging (Bezos, Musk, Zuckerberg) tied into digital infrastructure and commerce migration.

Summary: Key financial families often migrate their influence across borders, blending banking, governance, and emerging technologies.

Illustrated Timeline — The Migration of Financial Power

| Era | Center of Commerce | Key Families/Forces | Major Innovations |

|---|---|---|---|

| 330–1453 | Constantinople (Byzantium) | Byzantine merchant houses | Preservation of Roman law & trade |

| 1100s–1500s | Venice, Genoa, Florence | Medici, Venetian guilds | Maritime finance, early banking |

| 1500s–1600s | Spain, Portugal | Crown monopolies | Global colonization, bullion influx |

| 1600s | Amsterdam | Dutch merchant bankers | Stock markets, insurance, corporate charters |

| 1700s–1900s | London | Rothschilds, Barings | Central banking, industrial finance |

| 20th Century | New York | Morgan, Rockefeller | Bretton Woods, global dollar system |

| 21st Century | Emerging (Singapore, Dubai, Shanghai) | BlackRock, Tech Oligarchs | Digital finance, global surveillance capitalism |

Visual Theme: Migration of wealth mirrors shifts in military, legal, and technological infrastructure.