Frank Chodorov’s The Income Tax: Root of All Evil (1954) is a critical examination of the U.S. income tax system and its broader implications for individual freedom, government power, and society. Chodorov, a prominent libertarian and member of the Old Right, argues that the introduction of the income tax through the 16th Amendment (1913) fundamentally altered the relationship between the government and the individual, leading to a significant expansion of government control over private life.

Main Themes and Arguments

- Income Tax as a Threat to Individual Liberty: Chodorov argues that the income tax is more than just a way for the government to raise revenue—it represents a fundamental attack on individual freedom. By allowing the government to claim a portion of a citizen’s earnings, the income tax undermines the principle of private property. Chodorov sees taxation on income as a form of government ownership of the individual, as it grants the state a claim on the labor and productivity of citizens.

- Quote: “The government says, in effect, that it has a prior lien on all property, earned or inherited, and can levy taxes at its discretion. The government has thus established a master-servant relationship between itself and the citizens.”

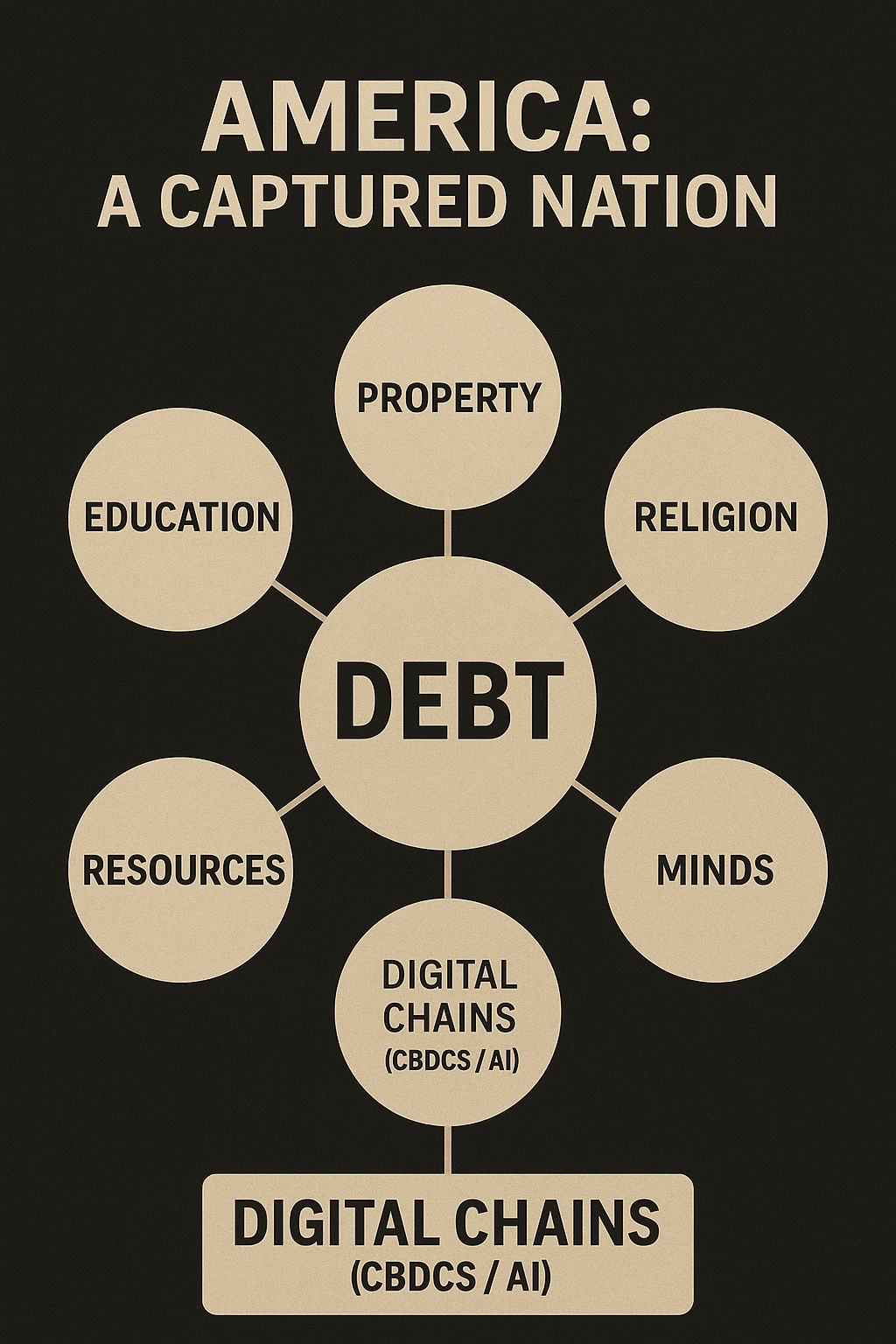

- Expansion of Government Power: Chodorov traces the growth of the federal government to the institution of the income tax, arguing that this tax enabled the massive expansion of federal programs and bureaucracy throughout the 20th century. Without the income tax, Chodorov argues, the government would have been limited in its ability to fund wars, social programs, and other large-scale interventions into society.

- He criticizes the way the income tax facilitated the New Deal programs of the 1930s, which he saw as further examples of federal overreach that interfered with free markets and individual autonomy.

- The Distortion of Incentives: Chodorov points out that income taxation distorts economic behavior by penalizing success and rewarding dependency. When individuals are taxed on their earnings, it disincentivizes hard work, entrepreneurship, and wealth creation. Conversely, government welfare programs funded by income tax revenue encourage reliance on the state, which Chodorov sees as harmful to personal responsibility and initiative.

- He contrasts a society where individuals keep the fruits of their labor and are responsible for their own welfare with one where the government redistributes wealth through taxation.

- Moral and Ethical Implications: Chodorov believes that the income tax represents a moral failing, as it allows the state to engage in legalized theft. He argues that the confiscation of private income through taxation is inherently unethical, as it violates the principle of voluntary exchange and consent. To Chodorov, the idea that the government can forcibly take money from individuals to fund programs that some citizens may not agree with is a violation of liberty.

- Historical Perspective: In the book, Chodorov gives a detailed historical overview of taxation, arguing that previous American generations—particularly the Founding Fathers—were opposed to direct taxation on income because they saw it as an infringement on individual liberty. He argues that the 16th Amendment, which allowed the federal government to tax income, was a break with the earlier constitutional tradition that limited the government’s power to tax.

- Quote: “Prior to the Sixteenth Amendment, taxes were laid primarily on imports and excises, which were indirect taxes. They were intended not as a burden on individuals but as a source of revenue incidental to commercial transactions.”

- The Role of War and Income Tax: Chodorov also emphasizes the connection between war and taxation. He argues that wars, particularly the World Wars and the Cold War, were only made possible by the income tax. Without the massive revenues generated from taxing citizens, the federal government would not have been able to finance large-scale military conflicts. He sees the income tax as inherently linked to imperialism and militarism, both of which expand government power at the expense of individual liberty.

Long-Term Consequences

Chodorov’s book outlines several long-term consequences of the income tax:

- Continued Growth of Government: The income tax enables government to grow indefinitely, funding a wide range of programs, initiatives, and bureaucratic agencies that expand the state’s reach into the daily lives of citizens.

- Erosion of Economic Freedom: As the state grows, individuals lose economic freedom, as more of their earnings are confiscated and redistributed.

- Loss of Personal Responsibility: As the government provides more services and welfare programs funded by taxes, citizens become less responsible for their own well-being, leading to a culture of dependence on the state.

- Distortion of the Market Economy: By taxing income, the state interferes with the natural functioning of the free market, discouraging entrepreneurship and reducing overall economic efficiency.

Present-Day Relevance

Chodorov’s arguments remain relevant to contemporary debates about taxation, government size, and individual freedom. His critique of the income tax aligns with modern libertarian and small-government movements that argue for a reduction in taxes and government intervention in the economy. Proponents of his views would advocate for a flat tax, consumption tax, or even abolishing the income tax altogether, in favor of a more limited government that focuses on protecting individual rights rather than redistributing wealth.

In summary, The Income Tax: Root of All Evil is a libertarian critique of the income tax system and its effects on American society. Chodorov sees the income tax as a tool of oppression that expands government power, erodes individual freedom, and distorts both moral and economic incentives. His ideas continue to influence anti-tax and pro-liberty advocates today.