Introduction

Baby boomers hold the largest concentration of private wealth in modern history. In the United States, those over the age of 55 control nearly 70% of household net worth. Much of this wealth lies in real estate, pensions, equities, and private businesses — accumulated over decades of economic growth and asset appreciation. But a structural transformation is underway. A global financial reset, framed as modernization, is quietly being implemented, and it targets this massive pool of boomer assets as the prime prize.

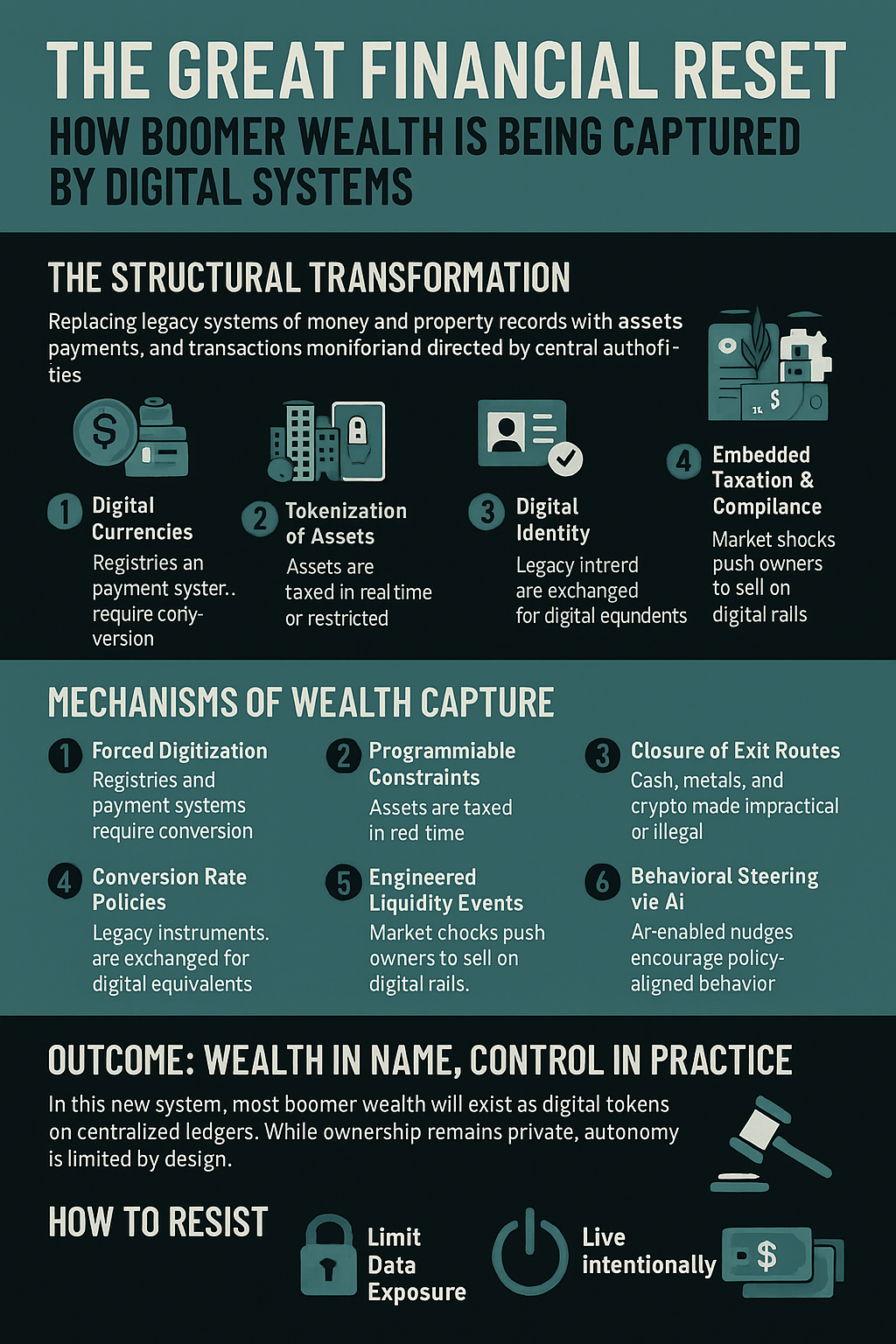

The Structural Transformation of Finance

The reset is not simply about making money “more digital.” It is a fundamental restructuring of how ownership, markets, and transactions operate. Legacy systems of money and property records are being replaced with fully digital frameworks — frameworks where every asset, payment, and transaction exists on programmable rails, monitored and directed by central authorities.

The Four Pillars of the Reset

- Digital Currencies (CBDCs and Stablecoins): Programmed with surveillance and control features.

- Tokenization of Assets: Real estate, equities, and bonds transformed into standardized digital tokens.

- Digital Identity: A state-verified key required for all financial transactions.

- Embedded Taxation and Compliance: Rules built into the very infrastructure, making oversight automatic.

Why Baby Boomer Assets Are the Target

Boomer wealth is both immense and illiquid. Property, pensions, and business equity cannot be easily mobilized under current systems. But by tokenizing these assets and moving them into digital frameworks, governments and creditors gain unprecedented leverage.

The largest intergenerational transfer of wealth in history — as boomers pass on assets to their heirs — presents a perfect opening. Public messaging frames the process as unlocking dormant capital and ensuring fairness across generations. But beneath the surface, it is a strategy of wealth capture at scale.

Mechanisms of Wealth Capture

The reset does not require overt seizure of property. Instead, it works through carefully designed system shifts and policies:

- Forced Digitization: Registries and payment systems migrate to tokenized form, requiring conversion of holdings.

- Programmable Constraints: Assets can be taxed in real time, restricted, or redirected to approved channels.

- Conversion Rate Policies: Legacy bonds, pensions, or cash exchanged for digital equivalents at manipulated terms.

- Engineered Liquidity Events: Regulatory or market shocks push owners to sell, forcing proceeds into digital rails.

- Closure of Exit Routes: Physical cash, metals, and crypto made impractical or illegal to hold.

- Behavioral Steering via AI: Every transaction generates data, enabling incentives and nudges that align owners with policy goals.

These mechanisms ensure that even when assets remain legally “private,” their use and value are controlled externally.

Implementation Phases

The reset is unfolding in distinct stages:

- Phase 1: Infrastructure Buildout — CBDC pilots, stablecoin rollouts, tokenized securities, and national digital IDs.

- Phase 2: Regulatory Anchoring — laws rewritten to accommodate tokenized property and inheritance.

- Phase 3: Compulsory Integration — registries and exchanges operate only in digital formats; paper records retired.

- Phase 4: Programmable Policy Leverage — assets and money embedded with compliance conditions, directing flows by design.

The Role of Digital Identity

Digital ID is the gatekeeper of this new architecture. Without it, no transactions can occur. Compliance checks and ownership conditions are tied to ID profiles, and access to assets depends on maintaining good standing within the system. In this way, wealth becomes inseparable from identity, ensuring enforcement of financial rules through personal compliance.

Shrinking Alternatives

Cash is under threat, precious metals face stricter reporting and possible tokenization, and offshore havens are pressured into compliance. The space for alternatives outside of the programmable system grows smaller each year.

The Outcome: Wealth in Name, Control in Practice

If fully implemented, the reset ensures that most boomer wealth will exist only as digital tokens on centralized ledgers. Ownership remains private in name, but autonomy over wealth — how it is used, transferred, or invested — is constrained by design. The reset is not just modernization; it is the structural capture of the largest pool of private wealth in history.

How to Resist

The key to preserving financial freedom lies in resisting the foundations of the system:

- Reject or minimize use of digital ID, the gateway to control.

- Limit data exposure by not linking ID to every online behavior.

- Live intentionally — disconnect when possible, and use cash.

- Cultivate offline and resilient forms of exchange and value.

Conclusion

The financial reset is unfolding as a quiet revolution, reshaping ownership itself. While framed as progress, its deeper purpose is control and capture. Boomers’ wealth, the largest private pool in history, is the primary target. The battle to resist lies not only in guarding assets but in defending sovereignty over identity, behavior, and the right to hold wealth outside programmable rails.

Point by Point Breakdown

1. Baby Boomer Wealth Concentration

- Boomers (55+) hold nearly 70% of household net worth in the U.S.

- Wealth is tied up in real estate, equities, pensions, private businesses.

- Accumulated via decades of asset appreciation, tax policy, and economic growth.

- “Boomer” is used demographically, not as a slur.

2. Structural Transformation (The Reset)

- Global financial reset underway.

- Replaces legacy money markets & ownership records with fully digital systems.

- Goals framed as modernization, efficiency, inclusion.

- Reality: wealth brought into centrally administered systems — monitored, programmable, directed by policy.

3. Four Pillars of the Reset

- Digital Currencies (CBDCs, stablecoins): programmable with surveillance features.

- Tokenization of Assets: real estate, equities, bonds, commodities digitized into tokens.

- State-verified Digital IDs: universal keys for all transactions.

- Embedded Compliance & Taxation: built into the infrastructure.

4. Why Boomer Assets Are Targeted

- Boomers hold large illiquid wealth: property, pensions, private company shares.

- Assets can be tokenized into digital formats.

- Intergenerational wealth transfer ahead (largest in history).

- With debts extreme, creditors see chance to bring wealth “onto digital rails” for tighter governance.

- Public framing: “unlocking capital” and “fairness between generations.”

5. Mechanisms of Wealth Capture

- Forced Digitization: property registries, securities, payments moved to tokenized formats. Existing holdings must be converted.

- Programmable Constraints: assets digitally restricted — taxed real time, transfers limited, investments directed. Owners hold title, but use is externally controlled.

- Conversion Rate Policy: legacy cash, bonds, pensions exchanged for digital equivalents at manipulated terms (reducing value).

- Engineered Liquidity Events: regulatory or market changes force sales, pushing wealth into tokenized system.

- Closure of Exit Routes: moving wealth into unmonitored forms (cash, metals, crypto) becomes impractical/illegal.

- Behavioral Steering via AI: every transaction logged; incentives (tax perks, speed) nudge compliance. Benefits (healthcare, retirement, credits) conditioned on participation.

6. Implementation Phases

- Phase 1: Infrastructure Buildout – CBDC pilots, stablecoins, tokenized securities, digital ID in banking/health/travel.

- Phase 2: Regulatory Anchoring – property/security/inheritance laws changed. Systems “optional” at first, incentivized.

- Phase 3: Compulsory Integration – official registries and exchanges only in tokenized form. Paper records retired.

- Phase 4: Programmable Policy Leverage – conditions embedded into assets (sales limits, automatic deductions, compliance rules).

7. Digital Identity’s Role

- Acts as the gatekeeper for all tokenized assets.

- Transactions impossible without valid ID.

- Compliance checks tied to ID profile.

- Access to assets depends on “good standing” in the system.

8. Shrinking Alternatives

- Cash under threat.

- Precious metals face tighter reporting & possible tokenization.

- Offshore havens pressured with compliance standards.

- Fewer alternatives remain outside the programmable system.

9. Outcome for Boomer Wealth

- Most boomer assets become digital tokens on central ledgers.

- All transactions require digital ID.

- Ownership remains private in name, but autonomy is constrained.

- Reset = not just modernization, but structural capture of wealth.

10. Recommendations (Resistance)

- Resist digital ID as the gateway to control.

- If already enrolled, limit data exposure; don’t link it broadly.

- Live intentionally: minimize digital footprint, turn Wi-Fi off when not needed.

- Use cash where possible.

- More will be revealed in future episodes.