“No government ever voluntarily reduces itself in size. Government programs, once launched, never disappear.” –Ronald Reagan

Ronald Reagan’s quote, “No government ever voluntarily reduces itself in size. Government programs, once launched, never disappear,” reflects his broader conservative philosophy of limited government and skepticism toward the growth of federal power. This statement draws attention to the tendency of government programs, once established, to become permanent fixtures, even if they no longer serve their original purpose or if they outlive their usefulness.

Detailed Explanation:

- Bureaucratic Growth: Reagan is criticizing the inherent nature of government bureaucracies to expand over time. When a government program or agency is established, it requires funding, employees, and resources to maintain it. Over time, these programs develop entrenched interests, including employees and beneficiaries, who will resist efforts to reduce or eliminate them.

- Institutional Inertia: Government programs, once created, are hard to dismantle because of bureaucratic inertia and political pressure. This concept is tied to what is known as “mission creep,” where programs gradually expand their scope beyond their original purpose to justify their continued existence and growth.

- Political Self-Interest: Politicians may be reluctant to eliminate programs because doing so could result in political backlash, particularly from groups that benefit from the programs. Eliminating government programs could mean layoffs for workers or reduced benefits for constituents, leading to a loss of political support.

- Reagan’s View of Government: As part of his overall critique of big government, Reagan believed that the larger the government became, the more it encroached on individual liberties and free-market principles. He famously said in his inaugural address, “Government is not the solution to our problem; government is the problem.” This encapsulates his belief that excessive government involvement stifles economic growth and individual freedom.

- Historical Examples: Reagan’s statement can be understood through the lens of historical examples where government programs have persisted, even after their necessity is questioned. For instance, many New Deal programs created in response to the Great Depression continued long after the Depression ended, and government agencies such as the Department of Agriculture have expanded in ways that extend beyond their original mandate.

- Conservative Ideology: This quote highlights a key aspect of conservative ideology, which emphasizes smaller government, personal responsibility, and free-market solutions to societal problems. Reagan’s presidency was marked by efforts to reduce government regulation and cut taxes, with the goal of limiting government’s influence over individuals and businesses.

Reagan’s quote expresses his belief that government, once it grows, becomes almost impossible to shrink, and that government programs, once started, rarely disappear because of the vested interests that develop around them. This principle was central to his efforts to reduce government size, cut spending, and curb the growth of the federal bureaucracy during his presidency.

Ronald Reagan’s critique of the ever-expanding government, particularly the idea that “government programs, once launched, never disappear,” ties directly into concerns about how government size impacts people’s earnings and increases taxes. Here’s a detailed explanation of how this plays out:

1. Increased Tax Burden

- Funding Government Programs: As government programs grow, they require continuous and often increasing amounts of funding. To sustain these programs, the government needs revenue, which typically comes from taxes. This can lead to higher taxes for individuals and businesses.

- Income Tax Rates: Over time, if more programs are created without eliminating old ones, the overall tax burden can increase, particularly on middle- and upper-income earners. Higher taxes reduce the amount of take-home pay, limiting disposable income and affecting people’s ability to save or invest.

2. Reduced Incentive to Work and Invest

- High Marginal Tax Rates: When tax rates rise, especially marginal tax rates (the tax on additional income), it can reduce the incentive to work harder or invest more. People may feel that the more they earn, the less they get to keep, which disincentivizes economic productivity.

- Tax on Investment and Capital Gains: Increased taxation often extends to capital gains, dividends, and investment returns, which reduces the incentive for individuals to invest in businesses, stocks, or property, ultimately slowing economic growth.

3. Crowding Out Private Sector Opportunities

- Government vs. Private Sector: When the government takes on more responsibilities, it can crowd out opportunities in the private sector. For example, if the government provides extensive social services or operates industries that could otherwise be privatized, it limits job creation and entrepreneurial opportunities in those sectors.

- Economic Inefficiency: Government programs are often seen as less efficient than private businesses because they are not driven by profit motives or competition. This can result in misallocation of resources, slower innovation, and reduced economic growth, all of which can suppress wages and earnings potential for individuals.

4. Debt and Deficit Concerns

- Government Borrowing: If taxes aren’t raised to meet the expanding costs of government programs, the government may instead borrow, leading to deficits. As government debt grows, interest payments increase, consuming more of the federal budget. Eventually, taxes may need to be raised or services cut to deal with this debt, which can further affect the economy.

- Inflation: Large deficits and debt can sometimes lead to inflation, which decreases the value of money. When inflation rises, people’s earnings do not go as far, and they can buy less with their income, which effectively reduces their real wages.

5. Redistribution of Wealth

- Social Welfare Programs: Many government programs involve redistributing wealth, usually from higher-income earners to lower-income earners, through progressive tax systems and social welfare programs. While this may support those in need, it can reduce the incentives for wealth creation and productivity at the higher end of the income spectrum.

- Business Taxes and Costs: Increased taxes on businesses to fund government programs often lead to higher costs for consumers. Businesses may also reduce wages, cut jobs, or pass on the costs to consumers through higher prices, which can affect the cost of living and the purchasing power of individuals.

6. Economic Growth Slowdown

- Regulatory Burden: As government expands, it often comes with increased regulations on businesses and individuals. This can slow economic growth, limit business expansion, and reduce job creation. A slower economy means fewer wage increases and reduced economic mobility for workers.

- Innovation Stifling: An overbearing government can also stifle innovation by creating barriers to entry for startups or imposing regulatory burdens on new technologies and industries. This limits job creation, wage growth, and the overall dynamism of the economy.

The expansion of government programs, coupled with an inability or unwillingness to reduce the size of government, can lead to higher taxes and a reduced earning potential for individuals. It can create a scenario where people’s disposable income is decreased through taxes, and economic growth is stifled due to inefficiencies, increased regulation, and decreased incentives to invest and innovate. Reagan’s warning highlights the long-term risks of a continuously growing government on personal financial health and overall economic prosperity.

The expansion of government size and the establishment of numerous government programs can lead to the creation of a bureaucratic state and what some refer to as a “deep state.” Understanding how this happens involves examining the dynamics of government growth, the development of complex administrative structures, and the potential for entrenched power within these systems.

1. Defining Key Terms:

- Bureaucratic State: A bureaucratic state is characterized by a large, complex, and often inefficient administrative apparatus that manages various aspects of public life. It involves numerous departments, agencies, and officials who implement government policies and programs.

- Deep State: The term “deep state” refers to a body of influential members within government agencies or the military who operate independently of elected officials, often exerting significant control over national policy and decision-making processes. It is typically associated with secrecy, lack of accountability, and entrenched power structures.

2. How Government Expansion Leads to Bureaucracy and a Deep State:

a. Growth of Government Programs:

- Increased Scope and Complexity: As government programs expand to address various social, economic, and political issues, the administrative structures required to manage these programs become more complex. Each new program necessitates its own set of rules, procedures, and oversight mechanisms.

- Specialization: To handle diverse functions, government agencies become highly specialized. While specialization can lead to expertise, it also creates silos where information and authority are compartmentalized, reducing overall efficiency and increasing the potential for redundancy.

b. Creation of Layers of Administration:

- Hierarchical Structures: Large governments tend to develop multi-layered hierarchies to manage their operations. This hierarchy can lead to a chain of command that distances decision-making from elected officials and the public.

- Red Tape: Bureaucratic processes often involve extensive documentation, approvals, and regulations, which can slow down decision-making and implementation. This “red tape” can make the government less responsive to citizens’ needs and more focused on maintaining internal procedures.

c. Entrenchment of Bureaucrats:

- Career Civil Servants: As government agencies grow, so does the number of career civil servants who work within them. These individuals may develop expertise and institutional knowledge that make them indispensable, potentially prioritizing agency goals over those of elected officials.

- Institutional Loyalty: Bureaucrats may develop strong loyalties to their agencies and colleagues, fostering a culture that resists change and maintains the status quo. This loyalty can create resistance to reforms or directives from higher authorities.

d. Centralization of Power:

- Decision-Making Authority: With more programs and agencies, decision-making authority can become centralized within certain departments or groups of officials. This centralization can reduce transparency and make it difficult for elected representatives to influence policies effectively.

- Information Control: Centralized agencies often control the flow of information, deciding what data and reports are shared with the public and elected officials. This control can obscure the true state of affairs and limit accountability.

3. Emergence of the Deep State:

a. Independent Operation:

- Autonomous Agencies: Certain government agencies operate with a high degree of independence from direct political control. Examples include intelligence agencies like the CIA or NSA, which often have their own agendas and operational directives.

- Secretive Operations: Agencies involved in national security, law enforcement, and regulatory oversight may engage in activities that are not fully transparent to the public or other branches of government, fostering an environment where a “deep state” can thrive.

b. Entrenched Interests:

- Power Networks: Long-serving officials and bureaucrats can form powerful networks that influence policy beyond the reach of elected leaders. These networks may prioritize their own interests or the interests of their sectors over those of the broader public.

- Lobbying and Influence: Deep state actors may work closely with lobbyists, interest groups, and private sector partners to shape policies and regulations in ways that benefit their agendas, often bypassing democratic oversight.

c. Lack of Accountability:

- Opaque Processes: The deep state thrives in environments where decision-making processes are not transparent. This opacity makes it difficult to hold deep state actors accountable for their actions.

- Resistance to Oversight: Efforts to increase oversight and transparency can be met with resistance from entrenched bureaucratic elements, further entrenching the deep state’s influence.

4. Implications for Society and Governance:

a. Reduced Democratic Control:

- Erosion of Accountability: When bureaucratic and deep state actors operate with significant autonomy, elected officials may find it challenging to implement their agendas or respond to constituent needs effectively.

- Disconnection from Public Will: The deep state can lead to a disconnect between government policies and the preferences of the electorate, undermining the principles of representative democracy.

b. Policy Inconsistencies:

- Conflicting Agendas: Different agencies and bureaucratic factions may pursue conflicting agendas, leading to inconsistent or contradictory policies.

- Inefficiency and Waste: The overlapping responsibilities and lack of coordination within a large bureaucratic state can result in inefficiencies, duplication of efforts, and wasteful spending.

c. Potential for Abuse of Power:

- Unchecked Influence: Without proper checks and balances, deep state actors can manipulate policies and decisions to serve their own interests or those of powerful elites, potentially leading to abuses of power.

- Suppression of Dissent: A deep state may work to suppress dissenting voices or opposition, stifling democratic debate and limiting freedom of expression.

5. Mitigating Bureaucratic Overreach and Deep State Influence:

a. Enhancing Transparency:

- Open Government Initiatives: Promoting transparency through open data, public access to information, and transparent decision-making processes can help reduce the power of bureaucratic silos and deep state actors.

- Whistleblower Protections: Encouraging and protecting whistleblowers who expose corruption or misuse of power can help uncover and address deep state activities.

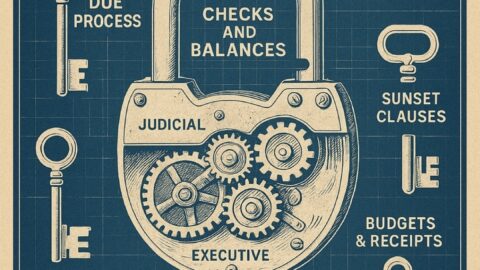

b. Strengthening Oversight Mechanisms:

- Independent Oversight Bodies: Establishing independent agencies or oversight committees to monitor government actions and ensure accountability can help check bureaucratic and deep state power.

- Regular Audits and Reviews: Conducting regular audits and reviews of government programs and agencies can identify inefficiencies, corruption, and abuses of power.

c. Promoting Accountability:

- Clear Lines of Authority: Defining clear lines of authority and responsibility within government can reduce the likelihood of power being concentrated in any one agency or group.

- Elected Officials’ Empowerment: Empowering elected officials with the tools and authority needed to oversee and direct government agencies can help maintain democratic control.

d. Encouraging Civic Engagement:

- Active Citizenship: Encouraging active participation in the democratic process, including voting, advocacy, and public discourse, can help ensure that government remains responsive to the will of the people.

- Education and Awareness: Raising awareness about the functions and influences within government can empower citizens to demand greater accountability and transparency.

The expansion of government programs and the growth of a bureaucratic state can inadvertently pave the way for the emergence of a deep state, characterized by entrenched power structures and limited accountability. This phenomenon poses significant challenges to democratic governance, transparency, and individual freedoms. Addressing these issues requires a multifaceted approach that emphasizes transparency, oversight, accountability, and active civic engagement to ensure that government remains responsive to and representative of the people it serves.