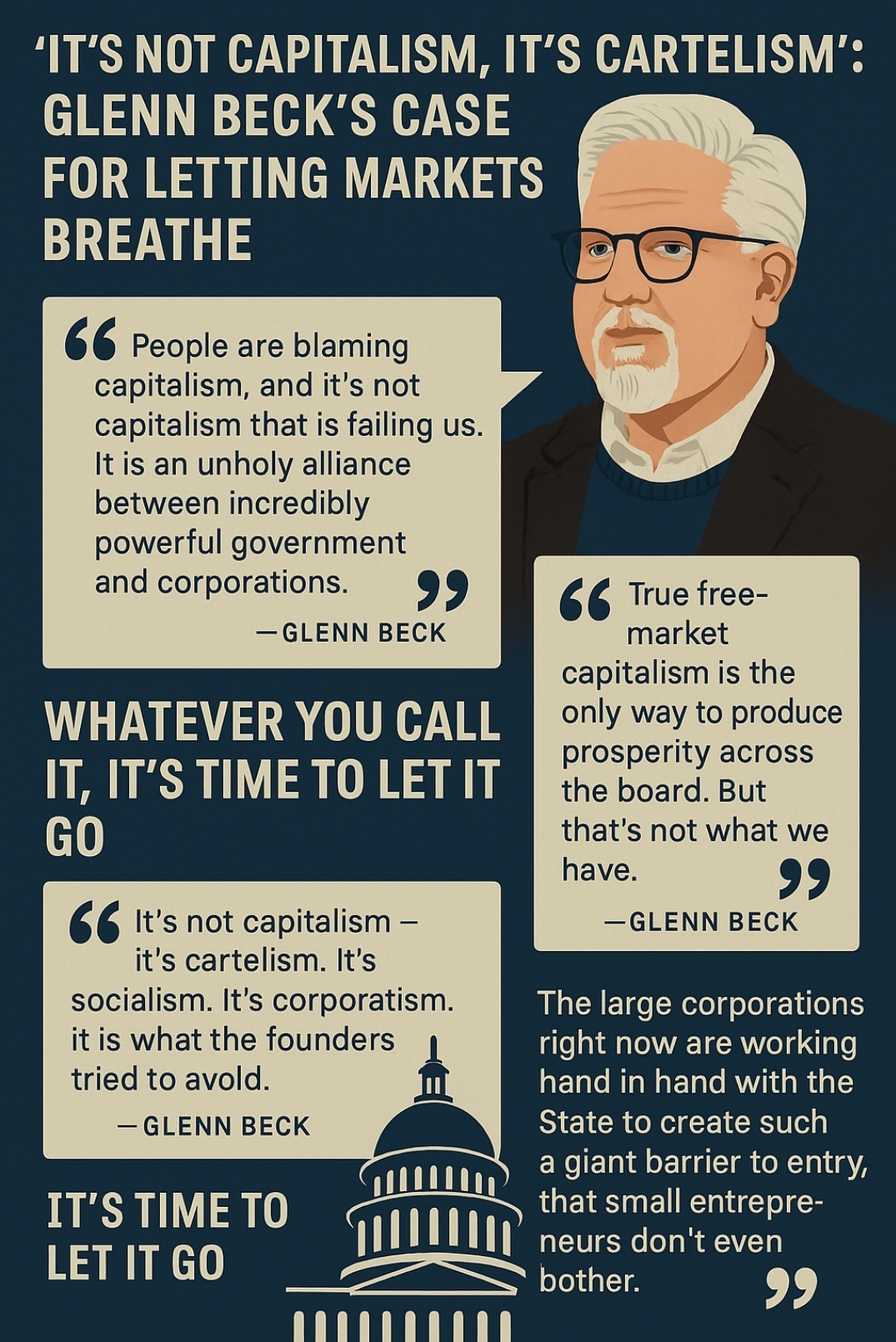

If the word “capitalism” makes your eyes glaze over, Glenn Beck thinks that’s because we haven’t actually lived under it for a long time. In a recent monologue, he argues the U.S. economy isn’t a free market but a cartel—an arrangement where government power and corporate muscle intertwine to protect insiders and discipline everyone else. Agree or not, his case is clear, provocative, and aimed squarely at people who feel the game is rigged.

Here’s the argument— and what he says to do about it.

The Cartel, Not the Market

Beck’s starting point is simple: stop calling our current system “capitalism.” In his view, a century of “progressive” reforms turned Washington into a deal factory—lobbyists draft the rules, politicians pass them, and when bets go bad, taxpayers fund the bailouts. The result isn’t competition; it’s protection.

His Exhibit A is the Federal Reserve, which he frames as a banking cartel rather than a neutral referee. Ordinary people don’t run it, he says, and the biggest banks shape outcomes from the top. Whatever else the Fed may be, Beck insists, it isn’t the free market—and he goes so far as to say it should be dismantled.

How It Feels on the Ground

For anyone under 40, he argues, this is the only economy you’ve known: high rent, suffocating debt, indecipherable medical bills, and a gnawing sense that when the powerful stumble, they get a soft landing. When you call that “capitalism,” people understandably reject it. Beck agrees reject it—because it isn’t the real thing.

Don’t Burn the System—Burn the Barricades

Beck’s twist is tactical. He doesn’t call for smashing markets; he calls for clearing the obstacles that keep markets from working.

- Housing: Scrap the thicket of zoning, rent control, and permit delays that choke supply. Let builders build, and prices fall the old-fashioned way—through competition. He points to reforms in Argentina under Javier Milei as a live example of deregulation expanding supply and lowering prices.

- Health care: Force price transparency—up front, like a menu—and make providers compete for patients. In his telling, today’s opaque bills and insurer-driven dynamics are artifacts of government rules that insulate incumbents and bury consumers in paperwork.

- Higher education: Deflate tuition by ending government guarantees that let universities raise prices with impunity. Beck’s contention: when Washington guaranteed the loans, colleges figured the money would always be there—and charged accordingly—while students got trained more in grievance than in skills.

- Corporate welfare: No more bailouts, no more rule-writing by lobbyists, no more subsidies that pick winners. If a company can’t win customers, it shouldn’t be able to buy a safety net on K Street.

Beyond Left vs. Right: Beck’s Anti-Partisan Critique

Beck argues the red/blue frame is a decoy. In his view, both parties have helped turn government into a cartel—a machine of lobbyist-written rules, subsidies, and bailouts that protect insiders. Democrats and Republicans “recycle old language,” he says, and mostly argue over the size of government while leaving its capture intact.

His prescription: stop treating economics like team sports and judge every policy by one test—does it empower the consumer or the planners? If it expands choice, transparency, competition, and entry (housing supply, price-posted health care, skills-first education, energy that competes on cost), it’s worth doing regardless of which party sponsors it. If it entrenches moats—mandates, carve-outs, guaranteed loans, corporate welfare—it’s the same cartelism in a different jersey.

Bottom line: the real divide isn’t Left vs. Right; it’s planners vs. people. Beck wants the U.S. to rediscover its radical instinct to trust citizens over central plans, and to measure success by how much power ordinary buyers and builders get back.

Put the Consumer Back at the Center

The heart of Beck’s “real market” is service, not status. You don’t get rich by capturing regulators; you get rich by easing someone’s day—faster commutes, cheaper energy, clearer bills, better tools. When businesses serve people first, prices tend to fall, quality tends to rise, and wages grow because small players can take on big ones rather than beg them for a job.

That flips the current power stack. Instead of corporate press releases about “caring” while service erodes, the scoreboard is set by your choice: who earned your dollar today?

Stop Defending “Capitalism as It Has Been”

Beck is blunt: defending the present arrangement as “capitalism” is a losing hill. He wants to retire the euphemisms and revive the substance—choice, risk, reward—applied broadly and fairly. That means fewer moats for incumbents and many more ladders for entrants.

And he doesn’t frame this as right vs. left. In his telling, both parties recycle slogans and argue only over the size of government, not its capture. The better debate is about who decides: planners or people.

The Historical Bet

When societies get anxious, they reach for control—central plans, strongmen, “this time we’ll do it right.” Beck says America’s miracle was the opposite: trust people more than planners. That trust fueled the world’s fastest climb out of poverty, lit homes, shrank distances, and put the internet in your pocket. If we want more of that dynamism, he argues, stop dragging the anchors—old rules, old subsidies, old protections—and let oxygen back into the system.

A Few Fair Questions

Even if Beck’s diagnosis resonates, some cautions are worth weighing:

- Guardrails vs. red tape: Where’s the line between necessary safety rules (environmental, health, consumer protection) and protectionist clutter? Scrapping barriers should be paired with clear, simple, narrow guardrails that protect people without insulating incumbents.

- Market power: Competition requires competitors. That implies serious antitrust where concentrated power blocks entry—again, to empower consumers, not punish success.

- Transitions: Deregulation done badly can create shocks. Sequencing matters: transparency first, then competition; build supply before removing controls; help people cross the bridge, don’t burn it behind them.

Those are implementation questions, not vetoes—and they fit Beck’s core test: does a rule serve consumers, or just the already-served?

What “Let it Breathe” Could Look Like

- Housing: Legalize more homes—by-right building, faster permitting, flexible codes, and the end of blanket rent caps that kill supply.

- Health care: Mandatory price posting for common services, portable insurance, deregulated clinics and telehealth, open networks so patients can shop.

- Education: Break the loan–tuition spiral with capped guarantees or income-share alternatives; fund students, not systems; scale skills-first pathways.

- Money & moats: Sunset subsidies, end industry-specific carve-outs, and bar lobbyist-drafted statutes. If a rule can’t be written in plain English and defended to the public, it doesn’t pass.

- Energy: Stop picking fuels; price inputs, clear the queue, and let producers compete to cut costs.

Make the New Old Again

Beck’s closing question is less ideological than personal: can we make the most American idea—trusting people—feel new again? Can we convince ourselves that the way out of high prices, low trust, and shrinking options isn’t a bigger maze but fewer walls?

You don’t have to buy every plank to grasp the through-line: call the current system what it is (cronyism), cut the ropes that tie down builders and buyers, and measure success by whether ordinary people—not bureaucracies or boardrooms—hold the power of “yes” and “no.”

That’s the free market Beck wants to try—perhaps, as he puts it, for the first time in our lifetimes.

Glenn Beck transcript — point-by-point outline (claims are his)

Core thesis

- Americans don’t live in a free market; for ~100+ years the U.S. has operated a cronyist cartel where government and large corporations collude.

- Words like “capitalism/free market” have become meaningless wallpaper in politics.

Banks & the Federal Reserve

- “The rich keep getting richer” because banks sit atop a cartel—the Federal Reserve.

- Claims the Fed is effectively controlled by the largest banks, unaccountable to citizens, and is not a free-market institution; argues it should be abolished.

Government–corporate nexus

- Bailouts show we don’t have markets: government rescues big firms.

- Lobbyists write most laws; lawmakers rubber-stamp them up to the presidency.

- System design protects powerful actors (e.g., names George Soros) while controlling ordinary people.

Lived effects he points to

- Younger generations have only seen the “rotten fruit”: crushing rent, debt, incomprehensible health-care bills, and bank bailouts while families struggle.

“You haven’t seen a free market”

- Repeats: what people see is a rigged game, a bastardization of America’s design built over a century.

What to “burn down”

- Don’t burn the system; burn the barricades:

- Red tape that blocks building.

- Zoning and rent controls that constrain housing supply.

Housing example (Argentina/Milei)

- Cites Argentina under Javier Milei: scrapping rent control allegedly tripled housing supply and lowered prices; asks why this isn’t headline news.

Health care reform ideas

- Require up-front prices (like a menu).

- Make doctors compete for patients rather than serve insurers.

- Says insurers became corrupt under government-set rules; bigger government won’t fix it—“government is the problem.”

Higher ed & student loans

- Tuition was far cheaper in the ’60s/’70s; costs exploded when government began guaranteeing loans.

- Universities, “in bed with government” (and teachers’ unions), could charge whatever they want.

- Claims schools indoctrinate revolutionaries rather than teach useful skills, leaving grads with debt and resentment.

Broader program: “make things actually work”

- Again cites Argentina: deregulation increased housing availability and cut prices.

- Says establishment ignores such examples because it’s not in their interest; warns listeners not to become “useful idiots” by asking for more regulation.

Not left vs. right

- Rejects Democrats vs. Republicans framing; both peddle old slogans and argue only about government size.

- Calls for trying the free market “for the first time in our lifetimes.”

Free market track record (as he frames it)

- True markets fed more people, reduced poverty, advanced health care, delivered energy, enabled travel and the internet.

- Warns against returning to systems that led to mass death/oppression in the 20th century.

Call to action: cut ropes, not burn boats

- Put the consumer back at the center—not government or corporations.

- Real wealth comes from serving people (entrepreneurship) vs. rent-seeking protected by government.

Specific outcomes he wants

- Energy prices falling via competition, not subsidies or government picking winners.

- Housing unlocked by allowing builders to build.

- Wages rising because small players can compete with big firms, not beg for jobs.

Reframing “capitalism”

- Stop defending “capitalism as it has been” (cronyism).

- Unleash freedom: real choice, risk, reward applied broadly in daily life.

Historical caution & American “miracle”

- In despair, nations reach for control: central plans, strongmen.

- America’s radical idea was to trust people over planners; that’s the “miracle” to revive.

Closing challenge

- Asks whether we can make that idea new again and convince people to believe in themselves rather than the actors who produced current misery.

Condensed policy levers he implies

- Deregulate housing: relax zoning/permit rules; end rent control.

- Price transparency in health care; foster provider competition; curb insurer–state entanglements.

- Reform/roll back student-loan guarantees; tie education to lower-cost, skills-focused paths.

- Limit corporate welfare/bailouts; curb lobbyist-written legislation.

- Increase market competition in energy and other sectors; avoid subsidy-driven picking of winners.

- Re-examine the Federal Reserve’s role (he favors abolishing it).