Charles August Lindbergh’s book, Banking and Currency and the Money Trust (1913), was a critical analysis of the banking system and the concentration of financial power in the United States during the early 20th century. Lindbergh, the father of the famous aviator Charles Lindbergh, was a Republican congressman from Minnesota and a vocal opponent of the Federal Reserve Act of 1913. He was highly critical of the banking establishment and the “money trust,” a term used to describe the powerful bankers and financiers who he believed manipulated the economy to their benefit.

Key Themes of Banking and Currency and the Money Trust:

1. Critique of the Federal Reserve Act:

Lindbergh was one of the most prominent critics of the Federal Reserve Act, which was passed in 1913 and established the Federal Reserve System. He believed that this act gave too much power to a small group of private bankers, who would control the nation’s money supply and use it for their own interests rather than the public good. Lindbergh argued that the Federal Reserve would create an inflationary system that would ultimately harm the economy and ordinary citizens, while benefiting the wealthy elite.

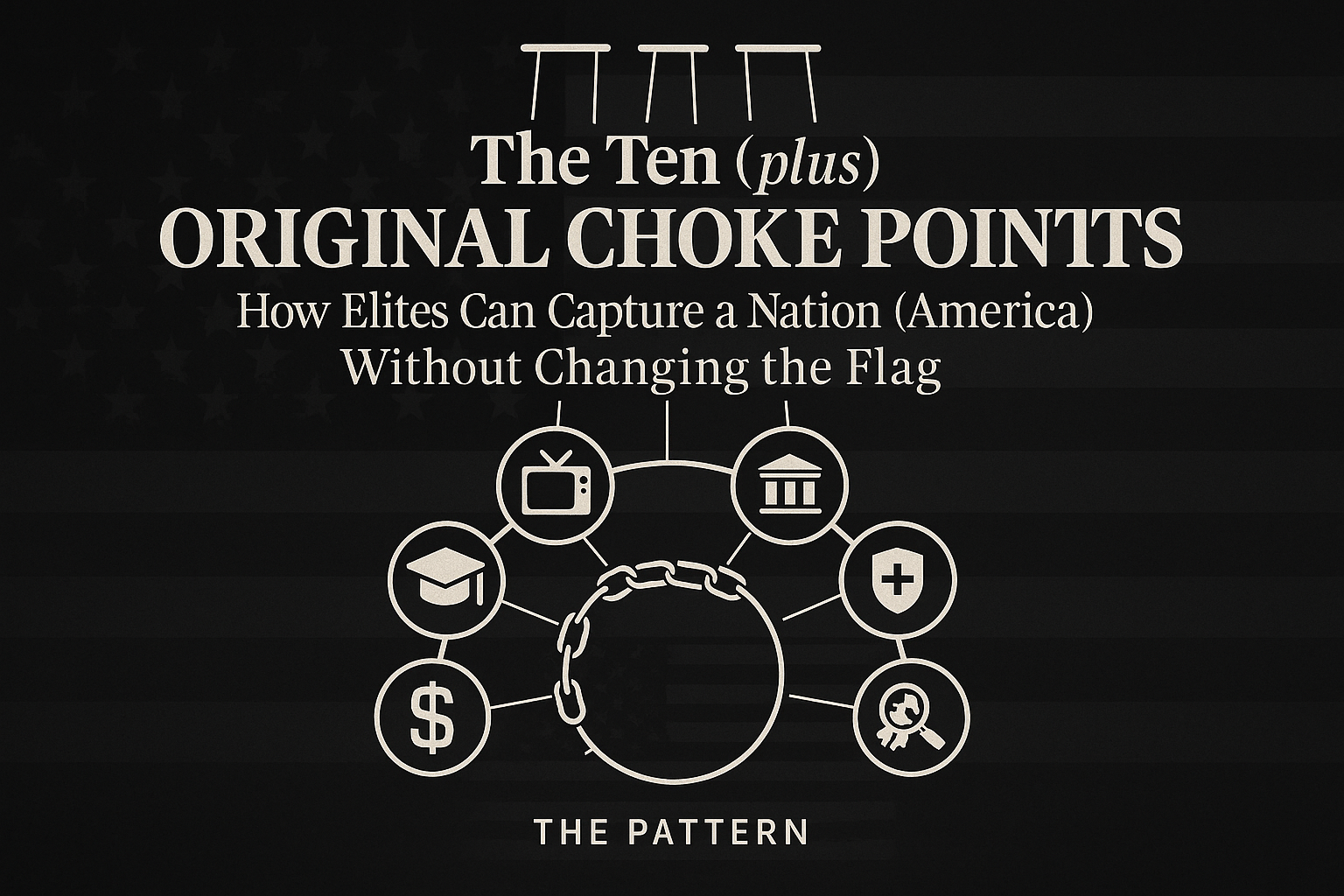

2. The Money Trust:

Lindbergh’s primary focus was on the “money trust,” a term that referred to the concentration of financial power in the hands of a few large banks and financiers, such as J.P. Morgan and his associates. He believed that these individuals and institutions were able to manipulate markets and control the flow of credit, giving them enormous influence over the economy and the government.

Lindbergh argued that the money trust’s control over banking and currency was a direct threat to democracy. He believed that by controlling the nation’s money supply and credit, these financiers could manipulate the economy for their own benefit, leading to widespread economic inequality and instability.

3. Calls for Reform:

In Banking and Currency and the Money Trust, Lindbergh called for significant reforms to the banking and monetary system. He advocated for the decentralization of banking power and the establishment of a more transparent and accountable system of currency control. He also called for more government oversight and regulation of the financial sector to prevent abuses by the money trust.

Lindbergh proposed a system in which the government, rather than private bankers, would issue and control the currency. He believed that this would prevent the kind of manipulation and economic instability that he saw as inherent in the existing system.

4. Anti-Monopoly Stance:

Lindbergh was deeply opposed to monopolies and the concentration of power in both the financial and industrial sectors. He saw the money trust as part of a broader pattern of monopolization that was undermining competition and democracy in the United States. He believed that the control of the banking system by a few large institutions was a form of economic tyranny that needed to be resisted.

5. Economic Populism:

Lindbergh’s ideas were rooted in the populist tradition of American politics, which saw the concentration of economic power as a threat to the rights and well-being of ordinary citizens. He believed that the money trust and the Federal Reserve were tools of the wealthy elite, designed to enrich themselves at the expense of the public. His critiques were aimed at defending the interests of farmers, small business owners, and working-class Americans, who he believed were being exploited by the financial system.

Lindbergh’s Warnings and Legacy:

Lindbergh’s warnings about the dangers of concentrated financial power and the Federal Reserve were dismissed by many at the time, but they have continued to resonate with critics of the banking system and monetary policy in later years. His book is often cited by those who argue that the Federal Reserve has too much influence over the economy and that its policies have contributed to financial crises and economic inequality.

While Lindbergh’s opposition to the Federal Reserve was not enough to prevent its creation, his work remains an important part of the early 20th-century critique of centralized banking and financial power. His book, Banking and Currency and the Money Trust, serves as a historical document that reflects the concerns of populists and reformers who sought to challenge the financial elites of their time.

Charles August Lindbergh’s Banking and Currency and the Money Trust was a passionate and detailed critique of the American banking system and the financial elite who controlled it. Lindbergh’s arguments against the Federal Reserve and the money trust were part of a broader populist movement that sought to challenge the concentration of economic power and defend the rights of ordinary Americans. His warnings about the dangers of centralized financial control remain relevant in discussions about monetary policy and economic inequality to this day.