When most people think of Jeffrey Epstein, they think of his trafficking network, his private island, or the endless list of powerful men who circled in and out of his orbit. What rarely gets attention, however, is the banking empire that made his operation possible — and how those same banks may have played a hidden role in the 2008 financial collapse.

The story is not just about one predator, but about how the largest banks in the world — JP Morgan and Deutsche Bank in particular — knowingly facilitated his activities, ignored red flags, and profited from his clients. It is a chilling reminder that Epstein wasn’t a lone wolf. He was part of a financial ecosystem that protected him for decades.

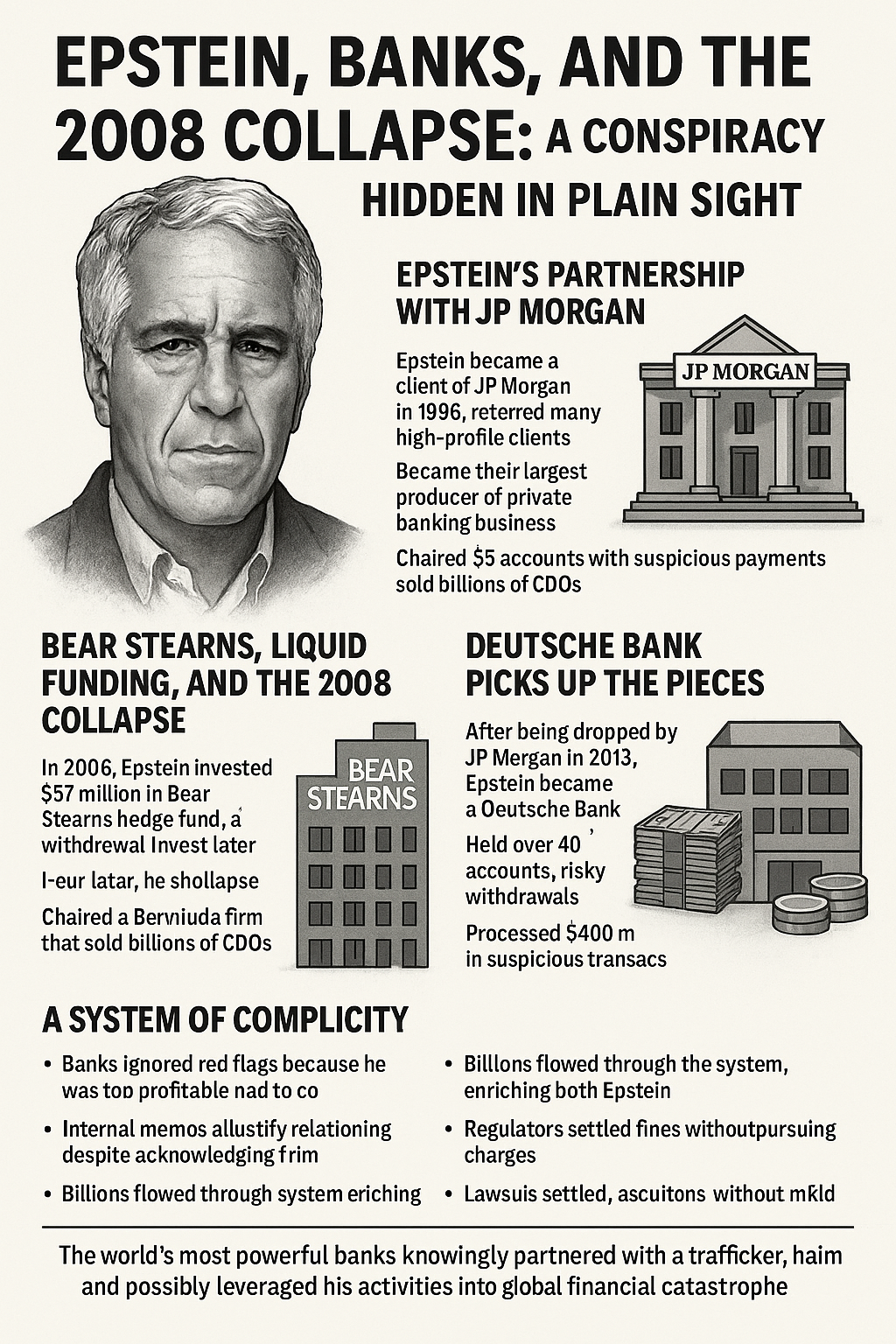

Epstein’s Partnership with JP Morgan

Epstein became a client of JP Morgan in 1998. By 2000, the bank’s CEO, Douglas “Sandy” Warner, was encouraging top executive Jess Staley to meet Epstein, describing him as “one of the most connected people in New York.”

Those “connections” soon brought in billions. Epstein referred high-profile clients such as Bill Gates, Sergey Brin, Larry Summers, Leon Black, Mortimer Zuckerman, and more. By 2011, Epstein was regarded as JP Morgan’s largest producer of private banking business, responsible for enormous profits.

The relationship went far beyond transactions. Emails show Staley writing Epstein from a hot tub on Epstein’s island during house arrest, waxing poetic about their “profound friendship.” Other emails reference “Snow White” and “Beauty and the Beast” — clear euphemisms for Epstein’s underage “catalog.”

Epstein’s accounts at JP Morgan included 55 accounts, hundreds of millions in assets, and at least $9 million in suspicious payments to victims and recruiters. Withdrawals of $40–80,000 in cash were routine, totaling $750,000 annually — the kind of red flags that banks are obligated to report. Instead, JP Morgan covered for him. Internal memos even admitted the bank was keeping Epstein only because of Jess Staley’s personal relationship.

This wasn’t negligence. It was complicity.

Bear Stearns, Liquid Funding, and the 2008 Collapse

The Epstein-JP Morgan connection didn’t just bankroll trafficking — it may have helped trigger the 2008 crisis.

In 2006, as federal authorities opened a sex-trafficking probe into Epstein, he quietly invested $57 million into a highly leveraged Bear Stearns hedge fund stuffed with mortgage-backed securities. The fund was leveraged 17:1 — meaning Epstein’s stake represented nearly $1 billion of exposure.

In 2007, just as Epstein negotiated his sweetheart plea deal, he pulled his entire investment. That sudden redemption hit Bear Stearns like a sledgehammer. Within months, the hedge fund collapsed, setting off the dominoes of the financial crisis.

Epstein wasn’t just an investor. He chaired a Bermuda firm called Liquid Funding Ltd., co-owned by Bear Stearns, that pumped out $20 billion in CDOs — the toxic financial products at the heart of the collapse. Conveniently, Epstein resigned just weeks before withdrawing his investment, insulating himself from the fallout.

When the dust settled, Bear Stearns had collapsed, JP Morgan acquired it for pennies on the dollar (with $30 billion in Fed assistance), and Epstein carried on as one of JP Morgan’s most valued clients.

Deutsche Bank Picks Up the Pieces

After JP Morgan cut ties under regulatory pressure in 2013, Epstein simply shifted to Deutsche Bank, with help from a former JP Morgan associate, Paul Morris.

Deutsche Bank opened over 40 accounts for Epstein-linked entities, classified him as “high-risk,” yet deliberately waived standard oversight. Epstein’s lawyers structured 97 withdrawals of $7,500 each — clearly designed to avoid reporting requirements — and the bank looked the other way.

Court documents later revealed Deutsche processed over $400 million in suspicious transactions linked to Epstein. Even after terminating him in 2018, staff wrote him glowing references to help secure new banking partners.

A System of Complicity

The evidence paints a clear picture: Epstein was not an anomaly in the financial system. He was a feature of it.

- Banks ignored red flags because he was too profitable and too connected.

- Internal memos acknowledged his criminality while justifying the relationship anyway.

- Billions flowed through the system, enriching both Epstein and the banks.

- Regulators slapped fines but never pursued meaningful criminal charges against bankers.

Even after Epstein’s death, JP Morgan and Deutsche Bank quietly settled lawsuits, paying millions without admitting guilt. The system closed ranks.

Why It Matters

The Epstein scandal is often treated as a lurid footnote — a story about sex, blackmail, and powerful men. But when viewed through the lens of finance, it reveals something more alarming: the world’s most powerful banks knowingly partnered with a trafficker, protected him, and may have even leveraged his activities into global financial catastrophe.

If true, the 2008 crisis was not only the result of reckless derivatives trading — it was entangled with one of the darkest criminal conspiracies of our time.

And that’s why the story matters. Because it proves that in our system, banks don’t just move money. They move morality. They decide which crimes are punished, and which are too profitable to touch.

As one commentator put it: “It’s a banker’s world. You’re just here to pay the interest.”

Here’s a point-by-point breakdown of the transcription:

1. Epstein’s Banking Ties

- Theory: Epstein may have contributed to the 2008 financial collapse.

- JP Morgan executives maintained close ties with Epstein, even while he was under house arrest.

- Example: Jess Staley (head of JP Morgan’s private client division) emailed Epstein from the hot tub on Epstein’s island, expressing deep gratitude and referencing “Snow White” and “Beauty and the Beast,” suggestive of underage trafficking connections.

- Epstein had 55 accounts at JP Morgan, handling hundreds of millions of dollars.

- At least $9 million in suspicious transfers identified, including $4 million linked directly to trafficking victims.

2. Banking Complicity

- Banks normally report such transactions, but Epstein’s were not reported.

- Evidence suggests JP Morgan acted as a partner in Epstein’s operation, not just a service provider.

- Internal memos flagged red flags, but were ignored because of Staley’s personal relationship and Epstein’s referrals.

- Epstein funneled high-profile clients (Bill Gates, Sergey Brin, Larry Summers, Leon Black, Mort Zuckerman, etc.) into JP Morgan.

- By 2011, Epstein was considered the biggest producer for JP Morgan’s private banking division.

3. Bear Stearns and the 2008 Collapse

- In 2006, Epstein invested $57 million into a highly leveraged Bear Stearns hedge fund tied to mortgage-backed securities.

- In 2007, while negotiating his sweetheart plea deal, Epstein suddenly pulled his investment.

- Because the fund was leveraged 17:1, his withdrawal equated to nearly $1 billion pulled out of the market, accelerating Bear Stearns’ collapse.

- Bear Stearns collapsed, and JP Morgan acquired it at a steep discount with help from the Federal Reserve.

- Epstein also chaired Liquid Funding Ltd., a Bermuda firm partly owned by Bear Stearns, which created billions in CDOs fueling the 2008 crash.

4. Deutsche Bank Era

- After JP Morgan cut ties (2013, under regulatory scrutiny), Epstein moved to Deutsche Bank, guided by Paul Morris (his former JP Morgan manager).

- Deutsche Bank created 40+ accounts for Epstein, labeling him “high-risk” but ignoring his criminal history.

- Epstein’s lawyer structured withdrawals ($7,500 each) to evade reporting rules.

- Deutsche Bank flagged $400 million in suspicious activity but did nothing.

- Even after terminating Epstein in 2018, staff wrote him glowing references to secure other banking relationships.

5. Regulatory Failures & Cover-ups

- JP Morgan and Deutsche consistently ignored internal red flags because Epstein was too profitable and well-connected.

- Epstein’s accounts were openly discussed in memos, showing banks knew of his crimes yet chose revenue over compliance.

- Court filings show banks continued payments to Epstein’s victims even after cutting him off, implying direct complicity.

- After Epstein’s death, JP Morgan reported over $1 billion in suspicious transactions—called a CYA move by investigators.

6. Broader Implications

- Banks enabled and benefited from Epstein’s trafficking network, making them co-conspirators, not bystanders.

- No high-level bankers have been criminally charged.

- JP Morgan sued Jess Staley for damages, but settlements remain confidential.

- The system protected itself: the government, corporations, and media all avoided exposing the depth of financial complicity.

- Quote: “It’s a banker’s world. You’re just here to pay the interest.”