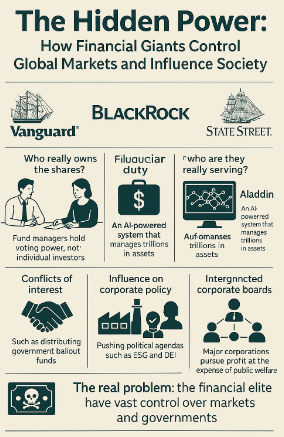

In today’s interconnected world, major financial institutions wield unprecedented power over global markets, corporate decisions, and even governments. Three giants—Vanguard, BlackRock, and State Street—dominate the financial landscape, managing trillions of dollars in assets. But this power is often hidden from public view, raising crucial questions about the role these entities play in shaping the world as we know it. In this article, we’ll delve into how these financial giants exercise control over the market, the political implications of their influence, and the hidden consequences for society.

The Big Three: Vanguard, BlackRock, and State Street

At the forefront of global financial management are Vanguard, BlackRock, and State Street, collectively known as “The Big Three.” These investment firms manage vast amounts of money, including retirement funds and other financial assets, for millions of people worldwide. If you have a retirement account, savings, or invest in ETFs or index funds, you’re likely already tied to one of these firms.

The Big Three have revolutionized the investment world by popularizing mutual funds, ETFs, and index funds—products designed to minimize risk and slowly grow wealth over time. These funds invest in a diversified portfolio of stocks, which helps spread risk but limits the potential for massive returns. While these investment products are marketed as a safe way for individuals to grow their savings, they also give the fund managers enormous power over the companies in which they invest.

Who Really Owns the Shares?

While it may seem that individuals owning shares in a mutual or index fund actually own a piece of the underlying companies, the reality is more complex. When you invest in these funds, you essentially “hand over” your voting rights to the fund managers, such as BlackRock, who control the shares on your behalf. This means that, even though individuals may hold a small portion of a company through their fund, the financial institutions are the ones with the real voting power.

The Big Three control 42% of the voting power in the top 100 companies in the U.S., and when combined with other financial institutions, they manage an astounding 83% of the voting power across major corporations. This concentration of voting power gives them tremendous influence over corporate decisions, including executive appointments, share buybacks, dividends, and overall company policies.

Fiduciary Duty: Who Are They Really Serving?

Historically, a company’s officers and directors had a fiduciary duty to act in the best interest of their shareholders. However, with the rise of institutional investors like BlackRock, Vanguard, and State Street, this duty has shifted. Today, the fiduciary duty of many companies is to the financial institutions managing their shares, not to individual investors.

For example, the Big Three fund managers have the power to influence corporate decisions based on their financial interests. If a company’s actions align with their financial goals—like making decisions that boost share prices through stock buybacks or pushing for certain policies—they will continue to push those changes, even if they aren’t in the best interest of the average consumer or investor.

BlackRock’s Power and Influence Through Aladdin

One of the key tools behind BlackRock’s dominance is Aladdin—an AI-driven supercomputer that monitors billions of trades and financial assets. Aladdin was created to assess risks and optimize investments, but it has become a powerful tool in BlackRock’s financial arsenal. Not only does BlackRock use Aladdin to manage its own assets, but it also sells its services to other financial institutions.

By 2020, Aladdin had grown to manage an estimated $21.6 trillion in assets across various sectors, including government pension funds, tech giants like Apple and Microsoft, and the top insurance companies. The level of control Aladdin exerts over global financial markets is staggering, and yet, very little is publicly known about its full range of clients or its influence on market behavior.

Conflicts of Interest: The Role of BlackRock in Government Bailouts

BlackRock’s influence is not confined to the private sector. In 2008, during the global financial crisis, the U.S. Federal Reserve enlisted BlackRock’s help to distribute taxpayer bailout funds. The company used its financial tools, including Aladdin, to allocate billions in taxpayer money to stabilize the financial system. This relationship between the government and BlackRock raised serious concerns about the concentration of power in the hands of a few financial firms.

The bailout of 2008 wasn’t the last time BlackRock played a pivotal role in government economic decisions. In 2020, during the COVID-19 pandemic, BlackRock once again advised the U.S. government on managing bailout funds. The firm’s role in these crises further underscores its outsized influence over both the markets and government decision-making.

The Big Three’s Influence on Corporate Policy

Beyond managing assets, the Big Three have used their voting power to push companies toward specific agendas, such as Environmental, Social, and Governance (ESG) and Diversity, Equity, and Inclusion (DEI) initiatives. These policies, while often seen as progressive, are also tied to the financial goals of BlackRock and its allies.

For example, BlackRock CEO Larry Fink has been vocal about forcing companies to adopt ESG and DEI policies. These policies, which prioritize sustainability and social justice, have become central to the Big Three’s investment strategy. However, critics argue that these initiatives may not always align with the interests of individual investors, especially when they are used as leverage to advance broader financial and political agendas.

The Power of Share Buybacks and Corporate Profits

The Big Three’s influence over corporate decisions is also evident in their support of stock buybacks—a practice where companies use excess profits to buy back their own shares, boosting their stock prices and benefiting major shareholders. Stock buybacks have surged in recent years, especially during periods of economic recovery like after the COVID-19 pandemic.

By directing companies to use their profits for buybacks, rather than reinvesting in research, development, or employee welfare, the Big Three help to concentrate wealth at the top of the financial pyramid, further widening the gap between the elite and the general population.

The Shadowy Network of Corporate Board Members

One of the most revealing aspects of the Big Three’s influence is the web of connections among corporate board members. The speaker points out that many of the same individuals serve on multiple boards across various industries, creating a tightly-knit network of powerful elites. This interconnectedness allows financial institutions like BlackRock to exert influence over a wide range of industries, from pharmaceuticals to tech to consumer goods.

For instance, the speaker highlights the connections between BlackRock’s board members and other powerful families, such as the Rothschilds and the Slim family, suggesting that these connections play a significant role in shaping global economic and political outcomes.

Corporate Scandals and the Pursuit of Profit

The article also discusses the role of major corporations in perpetuating scandals for the sake of profit. Examples like Johnson & Johnson’s cover-up of asbestos contamination in their baby powder illustrate the lengths to which some companies will go to protect their bottom line. The speaker argues that the real power in these corporations lies in their ability to influence policy and avoid accountability for their actions.

The Future of Corporate Power and Its Implications for Society

Ultimately, the article paints a picture of a world where corporate power is concentrated in the hands of a few financial institutions, and where these institutions use their influence to shape corporate policies, government decisions, and even societal values. This concentration of power not only affects the economy but also impacts democracy itself, as these financial giants increasingly control the decisions that shape our lives.

Conclusion: The Real Problem with Corporate Influence

The true issue with these financial giants is not just their market dominance, but their ability to shape the future in their own image—prioritizing profits over people, controlling voting power through retirement savings, and pushing political agendas under the guise of social responsibility. The Big Three’s influence over global markets and governments raises important questions about the future of capitalism and democracy. As more and more power gets consolidated in the hands of a few, it becomes increasingly clear that the system is designed to serve the interests of the wealthy elite, leaving the average person with little control over the forces that shape their lives.

Here’s a point-by-point breakdown of the concepts from the transcript:

1. Debunking BlackRock Conspiracy Theories (0:03-0:15)

- The speaker begins by addressing common conspiracy theories surrounding BlackRock, particularly the idea that BlackRock doesn’t actually own shares of companies. This is partially true but requires deeper context.

2. Introduction to the Big Three: Vanguard, BlackRock, and State Street (0:18-0:41)

- The “Big Three” are investment management firms—Vanguard, BlackRock, and State Street—responsible for managing large sums of other people’s money, including retirement funds. The speaker highlights that these firms often hold significant amounts of stock in various companies.

3. The Investment Model: Diversification and Index Funds (0:43-1:06)

- Vanguard pioneered mutual funds, and BlackRock popularized index funds and ETFs (exchange-traded funds). These funds are designed to minimize risk by spreading investments across a wide portfolio of stocks. The goal is slow and steady wealth growth, but this also means not maximizing returns in cases like GameStop.

4. Ownership and Voting Rights (2:25-2:53)

- When people invest in these funds, they sign over their voting rights to the fund managers, meaning BlackRock and similar companies control the voting power of shares in the companies they invest in. This gives them influence over decisions like board elections, dividends, and company policies.

5. Control Over Corporate Voting Power (2:56-3:12)

- BlackRock, Vanguard, and State Street control 42% of the voting power in the top 100 companies. Adding in other financial institutions, 83% of voting power is concentrated in the hands of a few firms, essentially controlling most major companies’ decisions.

6. Fiduciary Duty and Its Changing Nature (3:30-4:25)

- Fiduciary duty traditionally meant that company officers must act in the best interests of shareholders, but with most shares controlled by fund managers, the duty has shifted. Now, companies must act in the best interest of these managers and their financial agendas, rather than individual shareholders.

7. BlackRock’s Influence and Aladdin AI System (5:03-6:04)

- Aladdin, a financial supercomputer developed by BlackRock, monitors global financial markets and assesses risk. This system helps BlackRock and other major institutions track and manage trillions of dollars in assets. The speaker notes that BlackRock doesn’t disclose its client list, but Aladdin’s reach is vast, affecting global markets and key corporations.

8. Aladdin’s Role in Government Bailouts (6:04-7:03)

- In 2008, the U.S. Federal Reserve enlisted Larry Fink and BlackRock to use Aladdin to manage bailout funds during the financial crisis. Similarly, in 2020, BlackRock was involved in managing COVID relief funds, highlighting the close ties between private financial firms and government bailouts.

9. The Lack of Transparency and the Influence of Financial AI (7:07-7:29)

- The opacity surrounding Aladdin’s full client list and operations is pointed out. The speaker suggests that AI and supercomputers now dominate decision-making in financial markets, with little oversight or transparency.

10. Control of Corporate Decisions and Share Buybacks (10:00-10:42)

- The Big Three, particularly BlackRock, not only manage assets but also exert significant influence over corporate decisions. They use their voting power to steer policies like share buybacks and dividends, which primarily benefit the top shareholders and financial institutions, rather than individual investors.

11. ESG and DEI Agenda Push (10:43-12:22)

- Larry Fink and BlackRock are noted for pushing environmental, social, and governance (ESG) criteria, as well as diversity, equity, and inclusion (DEI) goals, on companies. The speaker critiques this practice, suggesting that it uses the power of institutional money to influence corporate policies and values in alignment with BlackRock’s broader agenda.

12. Influence on Corporate Boards (12:25-13:44)

- The speaker explains how BlackRock’s voting power influences corporate boards, with the company’s executives and fund managers selecting directors who align with their financial and political interests. This power is used to ensure that executives toe the line with BlackRock’s preferences.

13. Ties Between Powerful Families and Corporations (13:48-15:25)

- The discussion shifts to the interconnections between powerful individuals and companies, such as BlackRock’s board members having ties to global banking families like the Rothschilds and the Slim family, suggesting deep connections between finance, politics, and global business influence.

14. Conflicts of Interest in Pharma and the Gates Foundation (15:25-16:46)

- The speaker explores potential conflicts of interest within pharmaceutical companies, particularly Johnson & Johnson, as well as connections between corporate boards and entities like the Bill and Melinda Gates Foundation, pointing out how these ties often benefit corporate interests at the expense of public welfare.

15. Johnson & Johnson’s Asbestos Scandal (16:47-17:10)

- Johnson & Johnson’s cover-up of asbestos contamination in their baby powder is cited as an example of corporate malfeasance. The speaker highlights the contradictions between public health efforts and corporate greed, especially when corporate boards prioritize profits over the well-being of consumers.

16. Corporate Profits and Shareholder Interests (17:13-18:08)

- The article discusses the broader trend of corporate profits being funneled into shareholder accounts through stock buybacks, with special attention given to post-COVID stock buybacks, showing how financial institutions benefit from government bailouts while ordinary people receive little.

17. The Corporate Matrix and Wealth Distribution (22:28-23:03)

- The wealth and power concentrated in the hands of a few large financial institutions are criticized. The corporate matrix is said to be a system that benefits the few at the top while draining resources from the general public.

18. Corporate and Financial Power and its Impact on Society (23:10-23:36)

- The article concludes by emphasizing the immense influence that financial elites have over not only corporate policies but also government decisions, leading to a system where corporate interests are prioritized over those of the general public, creating a wider inequality gap.