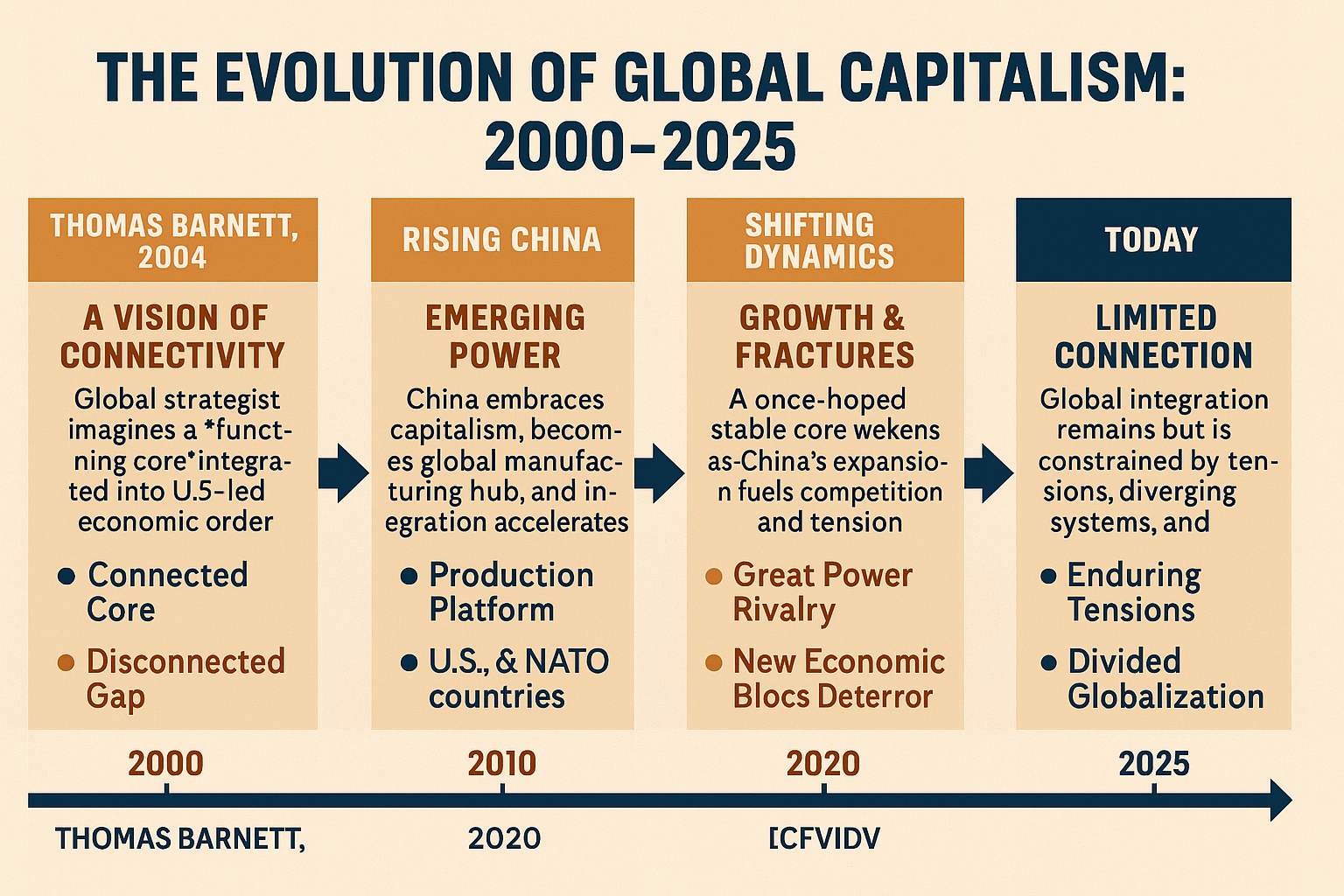

Introduction: Barnett’s Core Insights

Thomas P.M. Barnett’s analysis brilliantly anticipated major trends shaping the early 21st century. He captured the tectonic shifts occurring in global finance, economics, demographics, and security structures — particularly highlighting China’s ambitions, America’s evolving role, and the complex dangers lurking in the gap between economic integration and military mistrust.

Barnett’s framework emphasized that globalization isn’t merely an economic phenomenon — it is a strategic, political, and military transformation, with regions and powers moving through predictable stages of evolution.

Let’s walk through Barnett’s key points and then bring it into the present, showing how everything he foresaw is now unfolding.

I. The Second Flow: The Flow of Money

Barnett described globalization as being driven by five flows, but his favorite was the flow of money. In the 2000s:

- The United States was exporting debt.

- China was exporting manufactured goods and importing raw materials and technology.

- Europe was grappling with periphery debt crises (Greece, Italy, Spain).

- China aggressively poured capital into Africa, Latin America, and Southeast Asia — buying resources, building infrastructure, and setting up political dependencies.

Key points:

- China was bottom-feeding and buying distressed Western assets (especially in Europe).

- The U.S. resisted Chinese investment domestically, citing national security.

- China was massively investing in domestic infrastructure and lifting 750 million people out of poverty.

Today:

- China’s Belt and Road Initiative (BRI) formalized this global strategy.

- Chinese investments now dominate critical infrastructure in Africa, South America, and parts of Europe.

- The U.S. has finally acknowledged this by creating counter-strategies like the Build Back Better World (B3W) and Partnership for Global Infrastructure and Investment (PGII).

- However, Chinese financial expansion has slowed dramatically post-2020 due to debt crises at home (Evergrande, Country Garden) and international backlash (debt trap accusations).

II. China’s Economic Evolution: Not a New Model, but a Traditional Journey

Barnett debunked the notion that China was inventing a new “superior” economic model. He placed China’s growth on a traditional capitalist trajectory:

- Centralized Socialism → 2. Oligarchic Capitalism → 3. State-Directed Capitalism → 4. Big Firm Capitalism → 5. Entrepreneurial Innovation

Key challenges Barnett foresaw:

- Demographic collapse (one-child policy consequences)

- Decrepit infrastructure and pollution (smog, water scarcity)

- Resource dependencies (energy, food)

- Defensiveness and militarization (Taiwan tensions)

- Democratization pressures (middle class demands for rights)

Today:

- Every warning Barnett gave has manifested:

- China’s working-age population peaked in 2015.

- Pollution crises triggered sweeping (though still insufficient) reforms.

- China is now the world’s largest oil importer, making it vulnerable.

- Military spending continues to balloon — escalating Taiwan Strait tensions.

- Protests like those seen in Hong Kong and recent rural bank collapses show rising internal dissent.

- China’s economy now faces severe debt overhangs, a property crisis, and low youth employment (~21%+ unemployment in urban youth).

III. Asia’s Integration and China’s Regional Power Play

Barnett praised the economic miracle of East Asia’s peaceful integration:

- ASEAN, South Korea, Japan, Australia — all economically tied together and increasingly tied to China.

- China cleverly positioned itself atop the Asian supply chain, becoming the “final assembler” while pulling raw materials and components from neighboring countries.

- China’s Free Trade Agreements (FTAs) with ASEAN, South Korea, and others solidified this dominance.

Today:

- China’s dominance in Asia persists, but now faces resistance:

- Countries like Vietnam, India, Japan, and Australia are “de-risking” and diversifying away from China.

- New trade agreements like the Indo-Pacific Economic Framework (IPEF) and strengthened QUAD (Australia, Japan, India, USA) cooperation seek to balance China’s power.

IV. Globalization’s Double-Edged Sword: Mistrust and Militarization

Barnett pointed out the contradiction: America and China were economically codependent, yet militarily distrustful.

- Taiwan remained the flashpoint.

- U.S. Navy and Chinese military began escalating risky maneuvers.

- The “assassin’s mace” strategy (disabling U.S. power projection with missile strikes) versus America’s pre-emptive bombing doctrine created an unstable, hair-trigger situation.

Today:

- This dynamic has worsened:

- Near-misses between U.S. and Chinese ships/planes occur monthly.

- The U.S. has reinforced military alliances (Japan, Australia, Philippines).

- China has expanded bases in the South China Sea and opened a naval facility in Djibouti.

- Taiwan has become an even sharper geopolitical flashpoint.

V. Barnett’s Key Predictions and Their Realization

| Barnett’s Prediction | Status Today |

|---|---|

| China faces demographic decline | Confirmed |

| China becomes vulnerable due to dependencies | Confirmed |

| China fails to leapfrog the American model | Confirmed |

| Globalization will deepen integration and mistrust simultaneously | Confirmed |

| U.S. and China economic codependence vs military rivalry worsens | Confirmed |

| The transition from globalization based on free trade to one based on security alliances | Underway |

Concluding Analysis: Where We Stand Now

Barnett taught that globalization was a civilizational project — but also dangerous if mistrust and nationalism dominate over cooperation.

Today, we are at a critical inflection point:

- Globalization 2.0 is regionalized: U.S.-led blocs vs China-led blocs.

- Supply chains are shifting toward “friendshoring” and regional redundancy.

- Military buildups (in Taiwan Strait, South China Sea, Arctic, Space) are accelerating.

- Debt crises (China’s BRI countries, U.S. national debt, EU’s southern countries) threaten financial stability.

Barnett’s concept of “shrinking the gap” — connecting disconnected, unstable regions peacefully — is more urgent than ever. But today’s world leaders seem more focused on strategic rivalry than peaceful integration.

The choice remains:

- A divided, militarized, zero-sum world,

or - A world that acknowledges codependence and commits to peaceful integration.

So far, we’re sliding toward the former.